Jun 19, 2019

Foxconn Game of Thrones Looms as Its King Abdicates

, Bloomberg News

(Bloomberg Opinion) -- On June 11, for the first time in history, Foxconn Technology Group held an investor relations conference for its flagship company.

That’s the good news. The bad news is what the moment portends: The world’s largest electronics manufacturer is about to be left without a CEO.

It took founder Terry Gou’s pending departure from Hon Hai Precision Industry Co. to face its stakeholders beyond the legally mandated annual shareholders’ meeting. Gou didn’t even bother to turn up, choosing instead to continue his campaign to become Taiwan’s president.

After’s Gou’s departure, which could be as soon as Friday, Foxconn will have a new chairman, and the CEO role will be replaced by a committee of nine. For the past 45 years Gou has been the sole decider and face of the company. So while this major shift in leadership brings sudden and long-overdue transparency, it also leaves his sprawling company – which spans more than a dozen nations, up to one million workers, and an all-star client list – in the hands of a committee and without a chief.

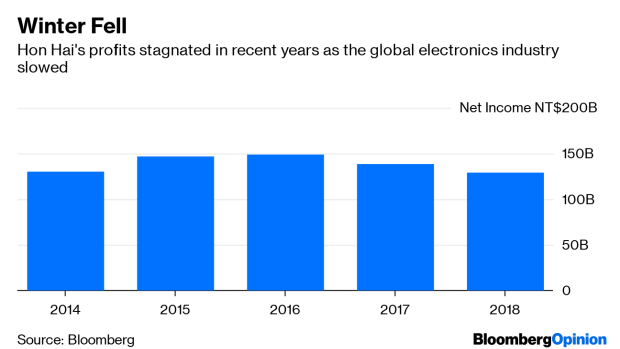

I’ve long been skeptical about the company and its future, with or without Gou. As the global tech industry faces both a macroeconomic slowdown and the fallout from U.S.-China trade tensions, Foxconn finds itself caught in the crossfire.

The comportment of the company’s new management now allays some of those concerns. At the investor event and a telephone conference that followed, these executives – many of whom had rarely spoken publicly – succinctly fielded questions about the challenges of running Foxconn in the age of President Donald Trump, the possibility of moving iPhone production out of China, and the company’s need to transform. That’s a refreshing change from the waffling, disjointed answers Gou usually gives to the media.

Still, this doesn’t mean everything is sorted. The debate over Foxconn’s next chairman, which has been raging for more than a decade, continues. Group CFO Huang Chiu-lian, known as Money Mama, was among the names tipped to take control. Heads of various divisions are also being considered.

It’s my belief that Young Liu, currently head of Foxconn’s chip division, will get that job. (Huang isn’t in the running since she won’t be on the new board). Getting the chairmanship, though, doesn’t mean taking Foxconn’s Iron Throne. Rather, this management-by-committee strategy sets the company up for possible infighting among various division chiefs, some of whom are part of that inner circle.

Any executive decision inevitably becomes a question of resource allocation. Since Foxconn is notoriously tight-fisted, divisions will likely need to compete with each other or engage in back-room horse trading to get what they want.

If the collegiality on display at the new team’s first public outing dissolves, then the executive lineup is likely to become a war of attrition. When Gou floated the idea of retirement a dozen years ago, he talked about winnowing his list down from more than 35 to less than 10 possible successors. But he’s never groomed anyone, unlike compatriot Morris Chang, who spent considerable time training up his successors for the company he founded and chaired, Taiwan Semiconductor Manufacturing Co.

More than a few people who follow Foxconn have told me they think that most lieutenants will retire pretty quickly if they don’t get clear control over the company once Gou steps down. As some depart, competition to take the reins may ensue.

My fear is that a series of departures and jostling will weaken Foxconn just when it needs stability and a single leader. Once that shakes out, any eventual winner may find that there’s no throne to take, let alone dragons to fight with.

To contact the author of this story: Tim Culpan at tculpan1@bloomberg.net

To contact the editor responsible for this story: Rachel Rosenthal at rrosenthal21@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Tim Culpan is a Bloomberg Opinion columnist covering technology. He previously covered technology for Bloomberg News.

©2019 Bloomberg L.P.