Dec 7, 2018

France Offers Euro Economy Small Hope Amid Mixed German Picture

, Bloomberg News

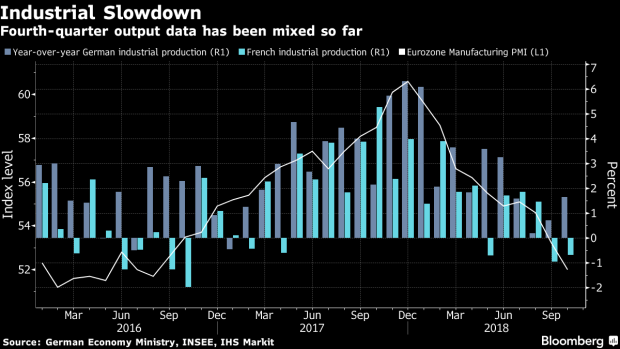

(Bloomberg) -- The euro area’s top two economies painted a mixed picture for the start to the final quarter of 2018, leaving the jury out on whether the region is in for a prolonged economic slowdown or a rebound in momentum.

French industrial output rose sharply in October, halting a recent disappointing trend as equipment manufacturing picked up. In Germany, production dropped, but there were signs of upward pressure in pay growth.

The numbers come less than a week ahead of the European Central Bank’s next policy meeting, in which officials will at least have the improving wage figures to point to when deciding to cap their asset-purchase program.

Economists have been predicting a bounce-back in euro-area economic indicators for months but numbers have continuously disappointed since September. As a result, expectations for a rebound have dimmed somewhat and economists see slower policy tightening by the ECB.

Data on industrial performance can be volatile from month to month and annual changes often tell a different tale. Still, the French figures are reassuring as violent protests around the country could threaten consumer spending in the fourth quarter.

Consumer and energy goods were a drag in Germany, which is also recovering from a summer blip in car production after new emissions-testing standards were introduced.

Despite weaker output, German labor costs went up the most in almost two years in the third quarter, a separate release on Friday showed. Such wage pressures have given ECB officials confidence that inflation remains on track toward the institution’s goal.

--With assistance from Kristian Siedenburg.

To contact the reporters on this story: Carolynn Look in Frankfurt at clook4@bloomberg.net;William Horobin in Paris at whorobin@bloomberg.net

To contact the editors responsible for this story: Paul Gordon at pgordon6@bloomberg.net, Jana Randow, Fergal O'Brien

©2018 Bloomberg L.P.