Feb 7, 2023

France’s Underlying Inflation Problem Is Becoming Stubborn

, Bloomberg News

(Bloomberg) -- Inflation is spreading through the euro area’s second-biggest economy to core goods and services that the European Central Bank is watching closely as it decides how much to continue tightening monetary policy to combat record price pressure.

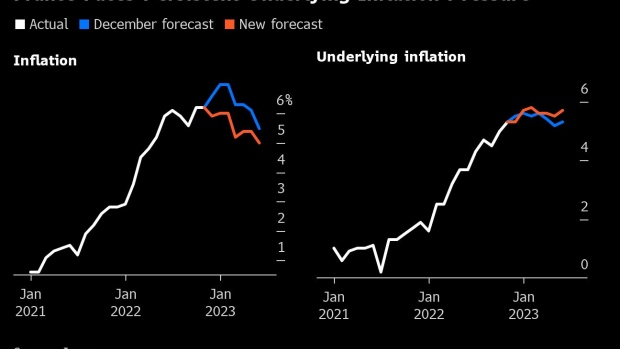

The reverberations from last year’s surge will keep underlying measures in France above the levels predicted in December, even as subsiding energy costs soften overall inflation, according to estimates from statistics agency Insee published on Tuesday.

It now expects the pace of price increases excluding volatile items such as fresh food and energy to overtake the headline rate in March and remain above 5.5% through June.

The change in the drivers of French inflation indicates the ECB’s battle is far from over. Policymakers have already flagged similar concerns as they justify keeping up the pace of interest rate hikes in the first months of the year.

Speaking earlier on Tuesday, Bank of France Governor Francois Villeroy de Galhau said underlying readings are still “much too high.”

“This state of nature is very important because monetary policy cannot do anything about energy prices obviously, but monetary policy is relevant for this broader inflation,” Villeroy told an online conference. “Monetary policy has to act and monetary policy is able to act to counter the rise in underlying inflation.”

Insee’s update of its French economic forecasts was more positive about growth in the first three months of 2023 after gross domestic product expanded at the end of last year, confounding its initial prediction of a contraction. The statistics agency now expects a 0.2% rise in output in both the first and second quarters.

Still, growth would need to accelerate to twice that rate to reach the government’s forecast of a 1% expansion for the full year, Insee economist Julien Pouget said.

“We expect a pretty limited rebound in household spending and there are mixed signals on investment,” he said.

©2023 Bloomberg L.P.