Jul 18, 2022

Franklin Templeton Targets $50 Billion of Assets in ETF Overhaul

, Bloomberg News

(Bloomberg) -- Franklin Templeton Investments, the roughly $1.4 trillion asset manager known for its mutual-fund business, has its sights set on getting bigger in the cut-throat ETF market.

The San Mateo, California-based company aims to quadruple its exchange-traded funds business to $50 billion in the next three years, said Patrick O’Connor, head of global ETFs. That would put it roughly within the top 10 ETF managers, though well behind industry heavyweights Vanguard Group Inc. and BlackRock Inc., who each have at least $1.8 trillion under management. Franklin said it had $12 billion in ETF assets at the end of the first half of the year.

The push into ETFs comes as the industry continues to lure in cash even as equities plunged into a bear market. The leading issuers have been in an arms race to cut fees as more firms seek to profit from growing demand for the funds. Franklin intends to increase its footprint in part by converting some long-standing mutual funds to ETFs, a move growing in popularity as a way to lure retail customers who prefer the tax benefits exchange-traded products offer.

“People want the ETF wrapper,” said James Seyffart, ETF analyst at Bloomberg Intelligence.

In December, Franklin announced plans to convert two mutual funds to ETFs. The BrandywineGLOBAL - Dynamic US Large Cap Value Fund and Martin Currie International Sustainable Equity Fund, subject to shareholder approval, are expected to be effective in the third or fourth quarter of 2022, according to the firm.

Converting funds helps managers sell the benefits of ETFs, such as their tax efficiencies. ETFs generate fewer capital gains for investors due in part to their creation and redemption process.

“If you go that route rather than launching a new fund, you get to carry over the assets and you also get to carry over your track record,” Seyffart said. “Some of these funds from Franklin have been around for decades. So if they can carry over those track records that can help with institutions and other people who are looking for a certain level of assets and a certain amount of history before they invest in a fund.”

While beefing up its ETF lineup, the firm is also overhauling its brand recognition. The firm in July filed to rename 17 of its ETFs effective August 1 to better align with a single, identifiable name.

“We’ve decided to clean up our brands,” O’Connor said. “We wanted something to provide more clarity so that was kind of an easy evolution for us.”

Franklin sits among America’s top 15 asset managers, data from Bloomberg Intelligence show. The firm has been snapping up asset managers such as Legg Mason in 2020, quantitative asset management firm O’Shaughnessy Asset Management in 2021 and Lexington Partners, a global manager of secondary private equity and co-investment funds, in the same year. This year, Franklin acquired BNY Alcentra Group Holdings, Inc. from BNY Mellon.

In May, the firm announced it will overhaul four of its index-based ETFs, including moving away from smart beta strategies and focusing on dividend-paying equities. The firm will reposition and rename Franklin LibertyQ Global Dividend ETF, Franklin LibertyQ International Equity Hedged ETF, Franklin LibertyQ Emerging Markets ETF and Franklin LibertyQ Global Equity ETF by August 1.

In June, Franklin launched the Franklin Responsibly Sourced Gold ETF (ticker FGLD) that’s priced at 15 basis points and trades on NYSE Arca to tap into the fast-growing industry of responsible investing.

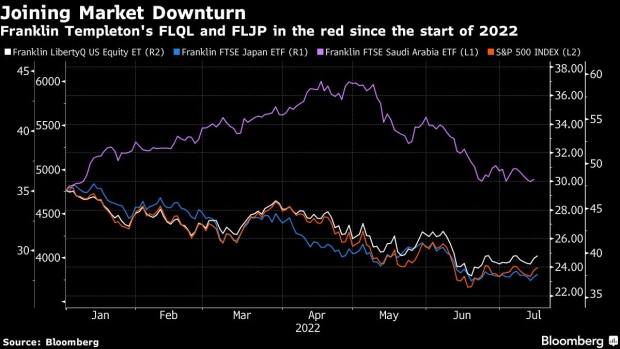

This year’s broad market selloff, marked by the S&P 500 Index’s decline of 19%, has also hit Franklin’s ETF lineup. Its roughly $1 billion Franklin LibertyQ US Equity ETF (ticker FLQL) is down 15.5% year-to-date while the $708 million Franklin FTSE Japan ETF (FLJP) is trading lower by nearly 20% in the same time frame. The only ETF with a positive return since the beginning of the year is the $3.5 million Franklin FTSE Saudi Arabia ETF (FLSA).

“It’s a stretch but that’s what we aspire to do,” O’Connor said of the $50 billion target. “The areas where we are likely to see most of this growth are in the firm’s passive equity and active fixed income lineups globally.”

©2022 Bloomberg L.P.