Mar 16, 2022

Freeland has more room to spend in April budget thanks to higher oil

, Bloomberg News

Freeland has more room to spend in April budget thanks to higher oil

Surging commodity prices are giving Finance Minister Chrystia Freeland breathing room to deliver on spending demands in next month’s budget without pushing Canada off a trajectory that will nearly balance the books in five years.

The government is set for an even bigger revenue windfall than it projected in December, economists say, as higher energy prices boost corporate taxes and fuel incomes in the world’s fourth-largest producer of oil.

Revenue could surpass projections by as much as $30 billion (US$23.6 billion) over the next two years, though the governing Liberals are likely to book a more conservative amount given extreme levels of uncertainty and volatility as a result of Russia’s war in Ukraine.

Still, the better-than-expected fiscal picture allows Freeland to deliver on campaign promises from last year’s election, along with new measures to spur growth and innovation, without fueling deficits that could stoke inflation that’s already at a three-decade high.

“This is the budget where they roll out their remaining platform pledges,” Rebekah Young, an economist at Bank of Nova Scotia, said by phone. Still, “the path for the deficit and the path for the debt will look pretty much like it did in the December update” because of higher revenue.

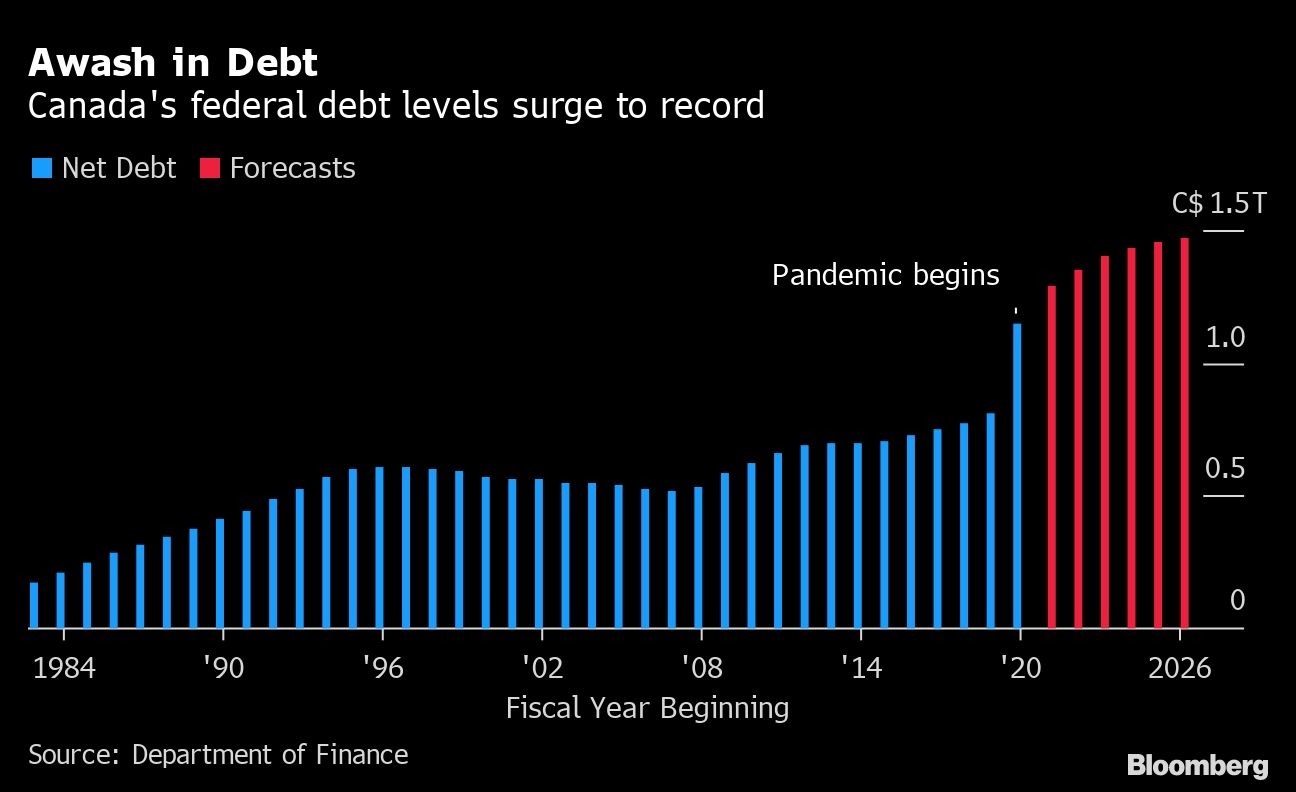

Freeland’s most-recent projections saw the deficit shrinking to $13 billion by 2026 after Prime Minister Justin Trudeau’s government ran budget gaps of nearly half a trillion Canadian dollars between 2020 and 2022 -- smashing post-World War II records.

December’s update, however, didn’t include the bulk of the $78 billion in new campaign promises, including large commitments for long-term care homes and measures to spur home construction. Officials say housing affordability will be the “storefront” component of the budget. Expected in the first week of April, it will be Freeland’s second full fiscal plan since taking over the post in August 2020.

There will also be other measures, including steps Freeland argues will bolster the nation’s long-term growth potential. Business groups are awaiting news on a tax credit for carbon capture utilization and storage, though new funding for the green transition is expected to be incremental this year given the government is still struggling to push billions of already-budgeted dollars out the door.

Overall the budget will be a low-key, circumspect affair that will stand in sharp contrast to the big spending exercises of the past two years.

It’s an acknowledgment there’s little justification for more deficit financing in an economy already at risk of overheating, thanks in part to tens of billions in pandemic stimulus checks that have yet to be spent. It’s also an attempt to repair some of Canada’s reputation for fiscal prudence after a deluge of emergency spending during COVID-19 prompted Fitch Ratings to strip Canada of its AAA credit rating in 2020 -- though the two other major agencies maintained it.

Current risks to the fiscal outlook -- both medium and long-term -- remain elevated and growing, despite the short-term boost to revenue. While the budget will be based on a still mostly rosy growth picture, the possibility of stagflation looms.

War-time pressure to ramp up defense spending, meanwhile, is a significant new risk, and adds to a list of future demands on the fiscal framework that is long and largely unfunded. Demands by provinces for more healthcare funding are acute, but the list also includes money for climate change and the Liberal government’s new marquee childcare program.

These pressures are mounting at a time when there’s much less room available as the nation copes with pandemic-related debt, with servicing costs marching higher as the Bank of Canada begins a cycle of interest-rate increases.

Surging oil prices, meanwhile, are no longer the elixir they once were for the economy as the government presses ahead with efforts to transition away from the fossil-fuel sector -- which is why the Canadian dollar hasn’t strengthened much on the back of higher commodity prices.

The flat dollar is a problem for the government because a strengthening currency is one of the key ways that benefits from rising oil prices are transmitted across the country.

Without that, pressure will grow on Freeland to help Canadians offset the rising cost of living -- like other governments are doing -- though there’s little sign of that happening in the current fiscal plan. A reluctance to stimulate the economy further and exacerbate inflationary pressures will likely be the argument Freeland uses to justify holding back.

“Given where inflation is, and the big structural long-term pressures, one question I would ask for every new dollar in spending is: Will it make our economy more productive and competitive in the long-run,” said Robert Asselin, a former Trudeau adviser who is now vice-president at the Business Council of Canada.