Jan 29, 2021

From bike spokes to high-value asset: Sports cards catch investors' eyes during pandemic

Growing value of collectibles like trading cards, coins as an investment

Chris Cassara knew he had a couple of gems inside his well-travelled box of sports cards that he's collected over the past few decades, but he didn't expect to come across a few diamonds in the rough.

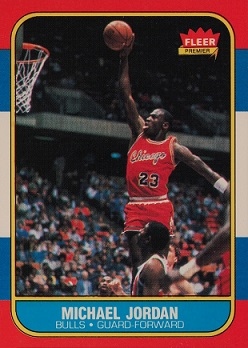

The 50-year-old former financial consultant owns three Michael Jordan Fleer 1986-87 rookie cards, which are among the most sought after basketball cards by collectors. He struck the jackpot when one of those cards was appraised as a PSA Gem Mint 10. That means that the card is in virtually perfect condition. It has an estimated value north of US$200,000.

"It's literally been sitting in my closet here. I had no intention of doing anything with it," he said in an interview. "But then I started seeing prices for it go up to US$100,000 and then US$150,000 and then I thought, 'It might be time to sell this thing.'"

Decades after kids used to rip open card packs to put between the spokes of their bike tires, it turns out those little pieces of laminated cardboard could be worth thousands of dollars or more.

Call it part nostalgia, part sports fanaticism, or part gambling, sports cards have emerged as a popular alternative investment over the past few years, with the pandemic leading some idle hands to stoke further interest in the now-lucrative hobby.

Chris Ivy, director of sports auctions at Heritage Auctions, which recently sold a Wayne Gretzky rookie card for US$1.29 million, said that interest in sports cards has been heating up. The auction house sold cards worth roughly US$100 million last year, up from about US$71 million in 2019, he said.

"I did not see this coming the way it has come from March of last year till now," Ivy said in an interview. "As the pandemic started, and I've said this to other people, we're not selling anything that people need to survive. But rather than slowing down the market, the pandemic has thrown gasoline on the fire."

With signs pointing to real money being made in the sports cards market, the hobby is increasingly catching the interest of Wall Street as institutional investors begin wading into the space.

Collectors Universe Inc., the company that Cassara used to evaluate his Jordan cards, is being taken over by an investor group led by entrepreneur Nat Turner, D1 Capital Partners L.P., and Cohen Private Ventures LLC, owned by New York Mets owner Steve Cohen, for US$92 a share. That price was increased from an earlier offer of US$75.25 a share last month.

But Montreal-based fund manager Pembroke Management Ltd. thinks that might be too low for the sports card authenticator. Stephen Hui, partner and portfolio manager at Pembroke, which owns about 3.5 per cent of Collectors Universe, told BNN Bloomberg in an interview that the offer undervalues the potential of the firm.

"Why should I sell this business that's generating a bunch of cash flows right in front of an unbelievable growth opportunity if you really do believe that this is an asset class that's emerging," said Hui.

While the fight for who will control the industry's main authenticator remains unsettled, other investors who would love to own one of Cassara's Jordan rookie cards could still get a piece of the action, but without the steep price.

Some fintech start-ups such as RSE Collection LLC, operator of Rally Rd., and Collectable Technologies Inc. are catching onto the collectible wave, providing investors the ability to own fractional shares of sports cards and memorabilia on a regulated platform. Next week, Collectable will permit its 14,000-odd users to trade those shares with each other on a secondary market, according to Ezra Levine, chief executive officer of Collectable.

The market itself will start small - users will be allowed to settle trades between 3 p.m. ET and 4 p.m. ET twice a week - but Levine thinks it'll catch on quickly.

"There's trillions of dollars which are being passively invested in very low-yielding asset classes, whether that is fixed income securities like bonds or real estate," Levine said in an interview. "Some of those funds are certainly starting to trickle in the collectible category."

Meanwhile, Mint10, a US$10 million fund backed by investors who also took early stakes in companies like Lyft, SpaceX, and Pinterest, was established late last year to snap up high-value cards once they hit the market. The fund isn't fully deployed, but it has already purchased some T206 cards, which were inserted in tobacco packs more than 100 years ago and are among the most valuable baseball card in the world. Sports cards collectors may remember one T206 card in particular: the Honus Wagner once owned by Wayne Gretzky and disgraced Los Angeles Kings owner Bruce McNall bought in 1991 for a then-record of $451,000.

Scott Keeney, who manages the Mint10 fund, said in an interview that he's being careful to avoid getting swept up in a potential sports cards bubble, taking stock of industry data, sports news, and cultural movements to help shape his investment strategy.

"While there's obviously risks with everything, you're holding a physical product and an alternative asset," Keeney said. "But there's just a lot of data that you need to do that's not easy for somebody to just jump into, so there's a slight learning curve for sports cards."

For Cassara, he's clearly caught the sports cards bug again. He recently spent a week at his parent's place scouring over the 100,000 cards he's collected since he was a kid. Maybe there were more gems that he'd forgotten about.

"I basically was sorting cards and evaluating cards for 12 hours a day, five days straight," Cassara said. "You know, 50,000 of those 100,000 cards were absolutely worthless. But having the time to go through that just brought back lots of memories of my favourite players back in the late 1970s and early 1980s."