Mar 21, 2023

Frustrated Lula Team Unloads on Brazil’s Central Bank Before Rate Meeting

, Bloomberg News

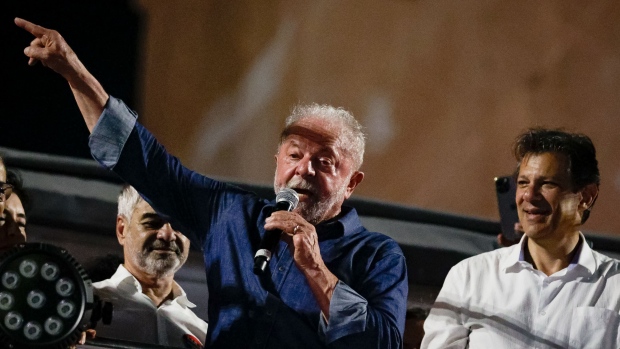

(Bloomberg) -- President Luiz Inacio Lula da Silva and key cabinet members spent the day before Brazil’s central bank sets interest rates berating its monetary policy in a series of media interviews and public appearances.

A benchmark rate of 13.75% is “absurd,” Lula fumed in an televised interview Tuesday morning, and policymakers are “irresponsible” for holding it there.

Hours later, Finance Minister Fernando Haddad called Brazil’s interest rates “excessively high” at an event held at the BNDES development bank headquarters in Rio de Janeiro.

The barrage of attacks comes as the government hammers out a new fiscal framework to shore up Brazil’s finances and ease concerns about public spending. Few details about the eagerly-awaited plan have been revealed. But Lula’s economic team’s public comments about the proposal have focused more on how it would help lower borrowing costs, and less on its budgetary effects.

Read more: Lula’s Team Vows Credible Budget After Clashing on Fiscal Plan

Haddad compared the country’s current interest rates to a “fatness” weighing on the economy. He also played down worries about consumer-price increases, which are now running at 5.6% annually, even as analysts grow increasingly pessimistic about the long-term outlook.

“Inflation is more controlled in Brazil than anywhere in the world,” Haddad said via video call from Brasilia.

While cabinet members had previously signaled that new fiscal rules would be released this week, Lula said Tuesday they will instead be unveiled after he returns from a trip to China at end of the month.

Since taking power for his third term on Jan. 1, Lula has lambasted the level of Brazil’s interest rates, now at a six-year high, as a major obstacle to growth. The leftist leader and his allies say high borrowing costs are holding up investment and hurting the nation’s poor, and they regularly unload their frustrations on the central bank and its president, Roberto Campos Neto.

No Cuts in Sight

So far, the jabs haven’t swayed monetary policy. Brazil’s central bank enjoys autonomy thanks to legislation passed in 2021, and policymakers are expected to keep the Selic unchanged when they conclude their rate-decision meeting Wednesday.

But the clash has raised investor concerns that Lula, 77, is trying to bend the monetary authority to his will. Brazil’s economy is flagging and the specter of a recession is endangering the president’s ambitious promises to boost living standards.

What’s Behind Lula’s Clash With Brazil’s Central Bank: QuickTake

Others worry Lula may be getting distracted from getting public accounts in order at a time when Brazil’s gross debt stands at 73.1% of gross domestic product — already far more than many emerging-market peers — and is expected to swell to 80% by 2026, according to government estimates.

This week, the government and the Brazilian Center for International Relations, a think tank, invited business leaders and renowned economists, including Nobel Prize winner Joseph Stiglitz and Jeffrey Sachs, to debate fiscal policy during the two-day event at BNDES. Instead, the discussions largely centered on the negative effects of Brazil’s expensive borrowing costs, with most participants joining the government’s criticism.

Read more: Stiglitz Joins Lula in Slamming Brazil’s Interest Rate Levels

Sachs, a professor at Columbia University, said that Brazil’s interest rates are “extraordinarily high” and that it is “very hard to understand or to justify the idea that Brazil is sitting on a powder keg of high inflation.”

Regardless of what justification the central bank gives for its decisions, Lula on Tuesday conceded that he may not be able to change its strategy until Campos Neto’s term ends in 2024. Still, he has no intention of letting up in the meantime.

“I’m going to keep banging, keep fighting to reduce rates for the economy,” he said.

--With assistance from Daniel Carvalho and Bruna Lessa.

©2023 Bloomberg L.P.