Feb 21, 2023

Frustrated Traders Missing Key Piece of Market Jigsaw Puzzle After London Firm Hacked

, Bloomberg News

(Bloomberg) -- “Frustrating,” “very annoying” and “left in the dark.”

These and similar expressions have been used to describe the near month-long blackout on key global investor positioning reports that cover bets on everything from Treasuries to soybean futures — the casualty of a ransomware attack on financial firm ION Trading UK.

The strike not only impacted options trading worldwide, but spurred the US Commodity Futures Trading Commission to delay its closely-monitored weekly datasets, a key window to the multi-trillion dollar derivatives market, until Feb. 24 at the earliest.

The timing couldn’t have been worse for those anxious to get a sense of investor positioning: positive sentiment toward a possible end to US rate hikes has morphed into concern there may be more increases to come. But market watchers have lost a key gauge of how different investor types, from hedge funds to asset managers, are reacting to the shift.

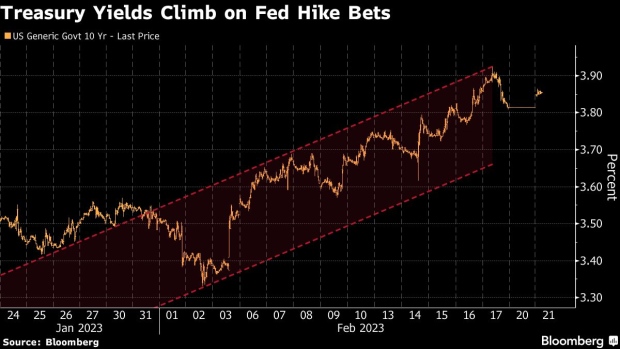

The 10-year Treasury yield, the global borrowing benchmark, has climbed to a new high for the year, volatility on the yen has jumped on speculation over Bank of Japan policy, while US natural gas has tumbled to a 28-month low thanks to a mild winter.

“We’re left in the dark — it’s very annoying that we don’t have positioning data at a time when Fed pivot bets have vanished,” said Prashant Newnaha, strategist at TD Securities in Singapore. “We’re missing a key piece of the jigsaw puzzle and it’s left market participants really scratching their heads.”

The attack on ION, blamed on Russian ransomware gang LockBit, is spurring a global assessment of cybersecurity in the financial system. Traders and brokers had to turn to spreadsheets to keep track of their deals and it’s left the CFTC to plot new security rules. It also spurred Wall Street banks to carefully review their trades sent through systems operated by ION.

“It has been a bit frustrating. Assessing the impact on short covering has been hard,” said Rodrigo Catril, a strategist at National Australia Bank Ltd. in Sydney. “There has clearly been a rise in hacking, cyber attacks and now everyone is coming to the realization that there is a desperate need to beef up tech security.”

The disruption was equally palpable 4,800 miles away in Tokyo.

Koji Fukaya, a veteran yen watcher, was left guessing on what speculators were doing with their Japanese currency holdings after news of Kazuo Ueda’s likely appointment as central bank governor whipsawed the nation’s currency.

“I can see market moves but the lack of data means I can’t confirm if speculative positioning has shifted,” said Fukaya, a fellow at Market Risk Advisory. “The absence of the data is troublesome.”

Lack of Confidence

Natural gas traders in Singapore also struggled to position themselves in the US market without the CFTC data, which includes long and short holdings for money managers. With the US gas benchmark falling, the lack of clarity means that at least two firms don’t have confidence to execute trades, according to traders, who requested anonymity to discuss private details.

Publication can’t come soon enough for market participants who want normal programming to resume in derivatives reporting.

But even that may not appease some in the market. The CFTC said it would begin with the report that was originally scheduled to be published on Feb. 3 and sequentially issue the missed reports in an expedited manner.

“We probably won’t get any fluid data for the next couple of weeks,” said Jessica Amir, strategist at Saxo Capital Markets in Sydney. “There’s not much we can do — for the moment we’re just continuing to look at price signals across markets.”

--With assistance from Masaki Kondo.

(Updates Treasuries move)

©2023 Bloomberg L.P.