Jan 26, 2023

FTSE 100 Gains Point to Rising Rental Values for London’s City Offices

, Bloomberg News

(Bloomberg) -- Gains in the FTSE 100 Index over the past year mean the cost of renting prime City of London office space is likely to become more expensive in the coming 12 months, according to Morgan Stanley.

Analysts at the US bank found a surprise correlation between the blue-chip gauge and the cost of renting space in the capital, stretching back over a period of three decades.

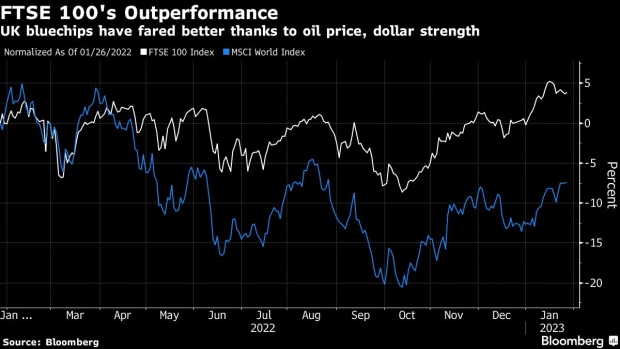

According to them, rents tend to track the FTSE 100 with a 12-month lag. In the past year, the benchmark is up about 4%, outperforming most major indexes thanks to its high exposure to buoyant energy stocks and value shares.

“Rental markets are driven by demand more than by supply,” analysts including Bart Gysens wrote in a Jan. 25 note. “And demand is driven by confidence. And the stock market is arguably a pretty good confidence barometer.”

Economists and investors are currently debating the extent to which property valuations, and potentially rental costs, might decline as Britain enters an expected recession driven by a cost-of-living crisis and soaring interest rates.

Yet, should the correlation identified by Morgan Stanley hold up, the cost of 1 square foot of London office space will rise to about £77.60 in a year’s time, based on a formula of the blue-chip index’s current value divided by 100.

--With assistance from Sam Unsted.

©2023 Bloomberg L.P.