Oct 11, 2019

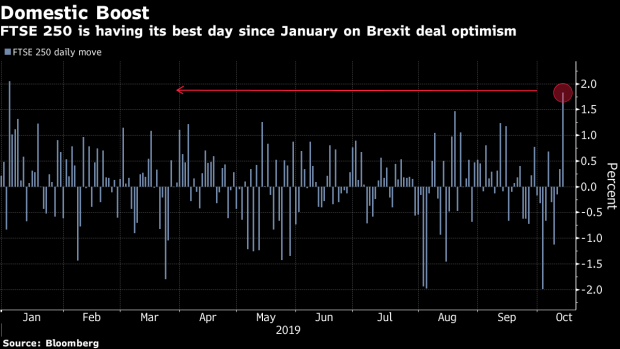

FTSE 250 Heads for Best Day Since January on Brexit Deal Hopes

, Bloomberg News

(Bloomberg) -- The U.K.’s gauge of mid-cap stocks raced toward its best day since January, boosted by a rally across companies exposed to the domestic economy on hope that the U.K. may reach a deal with the EU on Brexit.

The U.K.’s FTSE 250 Index surged as much as 2.2% after Irish Premier Leo Varadkar said Thursday that he believed an agreement is possible by the Oct. 31 deadline, following two-and-a-half hours of “constructive” talks with Prime Minister Boris Johnson. Ireland’s ISEQ All-Share Index jumped as much as 2.9%, also heading for its best day since January.

Top gainers included housebuilders Galliford Try Plc and Bovis Homes Group Plc, retailers Marks & Spencer Group Plc and budget airline EasyJet Plc. The blue-chip FTSE 100 Index, which has a high proportion of exporters and dollar-earners, underperformed as the pound rallied.

Among large cap stocks, Royal Bank of Scotland Group Plc and Lloyds Banking Group Plc, two of the U.K. banks with most exposure to the domestic economy, both surged more than 9% to have their best intraday gain in more than three years. Among decliners, big exporters GlaxoSmithKline Plc, British American Tobacco Plc and Diageo Plc all fell.

--With assistance from Joe Easton.

To contact the reporters on this story: Kit Rees in London at krees1@bloomberg.net;Michael Msika in London at mmsika4@bloomberg.net

To contact the editors responsible for this story: Celeste Perri at cperri@bloomberg.net, Beth Mellor

©2019 Bloomberg L.P.