Feb 7, 2023

Fund Bosses Start Turning Backs on ESG Indexes After Downgrades

, Bloomberg News

(Bloomberg) -- Investment managers are cooling to indexes that were once viewed as a safe ticket to the highest ESG fund designation.

Climate-transition and Paris-aligned benchmarks, intended by the European Union to help fund managers track some of the world’s cleanest assets, have had a bad run in recent months. Until late last year, funds tracking them assumed they could automatically claim the EU’s top environmental, social and governance tag, known as Article 9. That turned out not to be the case.

Against that backdrop, some investors are now looking for greener alternatives.

“We are moving to our own benchmarks,” Dominique Dijkhuis, a member of the executive board and head of investments at ABP, Europe’s largest pension fund, said in an interview. The idea is to track and invest in fewer companies to deliver the kind of portfolio management that can realistically drive a transition away from high-carbon activities, she said.

That means “large stakes in the companies that we then still hold,” Dijkhuis said.

ABP isn’t alone in deciding that Europe’s climate benchmarks don’t offer a sure-fire path to a carbon-free future. The asset management unit of Nordea Bank Abp, which runs the world’s biggest Article 9 fund, dodged the latest wave of downgrades precisely because it didn’t design Article 9 index funds around the benchmarks, according to Eric Pedersen, head of responsible investment at Nordea Asset Management.

That’s “where I think some people got wrong-footed,” Pedersen said in an interview.

Among them was the investment arm of Svenska Handelsbanken AB, which downgraded billions of euros worth of Article 9 funds that had tracked an EU-compliant benchmark.

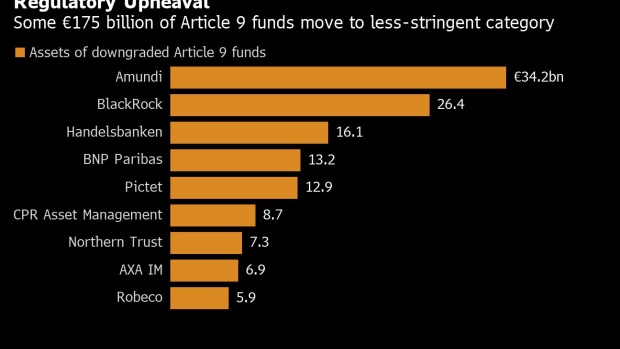

“We would welcome further clarifications and supervisory convergence on this issue,” said Aurora Samuelsson, head of sustainability at Handelsbanken Fonder. The Stockholm based firm removed the Article 9 designation from €16 billion ($17.2 billion) of Article 9 funds last quarter. Other asset managers that took similar steps include BlackRock Inc. and Amundi SA.

Doubts around the ability of indexes to address serious environmental and social issues coincide with a growing sense of urgency to come up with genuine ESG investing solutions. That’s as scientists warn that the goal of limiting global warming to 1.5C is looking increasingly out of reach, leading many investors to review their portfolio allocations.

Sindhu Krishna, head of responsible investments at Phoenix Group and co-author of a November report outlining key principles for designing benchmarks, said it’s now clear that existing policies around the globe “aren’t adequate” to guarantee a 1.5C trajectory. Even 2C is starting to look like a stretch, so to “just go on tracking a market-cap benchmark” is no longer appropriate, she said.

Aggregate data suggest that most fund managers targeting the EU’s highest green standards decided against indexes at the end of 2022. The share of passive Article 9 products fell to 5.1% in the fourth quarter from 24.1% in September, Morningstar Inc. estimates.

Benchmarks calling themselves climate transition or Paris-aligned must meet certain standards set by the EU. These entail excluding companies that make controversial weapons and tobacco, or those with revenue from coal, oil and gas that exceed set limits. The criteria also require delivering a 7% annual decline in emissions, in order to bring the benchmark in line with the goal of limiting temperature rises to 1.5C.

Nicolas Redon, lead author of a recent study on Article 9 funds by the Paris-based ESG data and analysis provider Novethic, said the EU-compliant benchmarks weren’t designed with the top ESG designation in mind. Instead, they’re “first and foremost a tool to meet the European Commission’s objective of aligning passively managed capital with decarbonization trajectories compatible with the pace required by the Paris Agreement.” And, they’re “intended to help move capital at scale,” he said.

ABP, meanwhile, is continuing to rid itself of assets that it thinks won’t transition in time. That entails creating entirely new benchmarks. The pensions investor has already mostly completed its divestment of a €15 billion portfolio of fossil-fuel assets, and recently said it would be ready to start divesting banks that don’t rein in their financed emissions.

“If certain companies or business models are just intrinsically harming the environment and aren’t in line with Paris Agreement,” then “our view” is to exclude them, Dijkhuis said.

In all, ABP is in the process of exiting more than half the companies it currently holds. The exercise, first announced late last year, is likely to be completed in roughly a year’s time, she said.

“From a risk perspective, if you’re not considering your investments from this sustainability angle and a sustainable economy, actually you’re taking a lot of risk,” Dijkhuis said.

©2023 Bloomberg L.P.