Jun 5, 2023

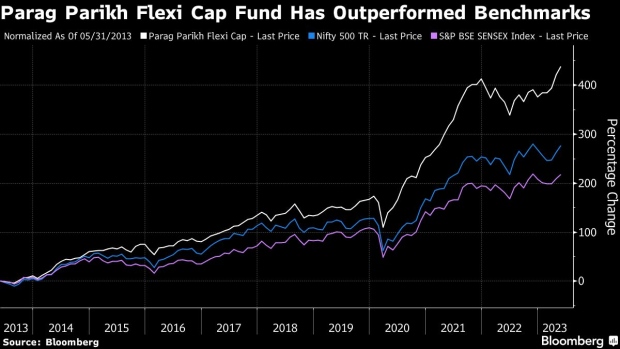

Fund Manager Trounces Most India Peers Betting Against ESG Trade

, Bloomberg News

(Bloomberg) -- Even as ESG investing gains traction globally as one of the hottest strategies, one Indian fund manager’s bet against the trade has proved to be a big boon.

The Parag Parikh Flexi Cap Fund boosted holdings of Asia’s largest cigarette maker ITC Ltd. and the world’s top miner by production Coal India Ltd. at low valuations three years ago, when some large investors balked at them. Those bets helped the fund deliver a return of 14% so far this year, outperforming 90% of its peers.

“For some time the whole thinking in the investing world was that everything should be ESG and how can you have fossil or tobacco companies,” Rajeev Thakkar, who manages about $4 billion as the chief investment officer for Parag Parikh Financial Advisory Services Ltd., said in an interview last week.

Global funds, especially money managers based in Europe, have been trimming their exposures to tobacco, coal and oil companies in recent years to comply with their environmental, social and governance mandates. That drove the valuations of companies in these sectors to “ridiculously low levels,” and that’s when we realize there lies a great opportunity, Thakkar said.

READ: Meme Stock ITC Is Top Gainer as Adani Saga Spurs Rush to Quality

European funds’ ownership of ITC shares declined by about 5% over the past five years, according to data compiled by Bloomberg. Abrdn PLC, Deutsche Bank AG and Principal Financial Group Plc are among funds that narrowed holdings in the firm, which earns more than 40% of its revenue from tobacco.

ITC’s shares trailed the Sensex for five out of eight years through 2020 but have turned into one of the benchmark’s best performers since then, a period during which Thakkar raised his fund’s holdings in the Kolkata-headquartered firm, which counts British American Tobacco Plc among its key stake holders.

The fund has ITC as its second-largest holding and Coal India as the tenth-biggest, according to the latest filing. The coal producer’s shares have more than doubled since a 2020 low. It also has one-fifth of its investments in US companies, including Microsoft Corp and Alphabet Inc.

Thakkar’s conviction in ITC and Coal India is also guided by the companies’ strategy to wean away from their traditional businesses. ITC is looking to expand its presence in consumer space, agriculture and information technology, while Coal India is investing into gasification and renewable energy.

“They are clearly working toward a transition, and what matters for us is the direction rather than the current position,” said Thakkar. “Obviously things cannot change overnight and it has to be a process, which we invested and sort of benefited from.”

--With assistance from Satviki Sanjay.

©2023 Bloomberg L.P.