Dec 15, 2020

Fund Managers See Bitcoin Trade Crowded as Institutions Jump In

, Bloomberg News

(Bloomberg) -- Bitcoin’s dizzying rally in 2020 has captivated the professional investing class.

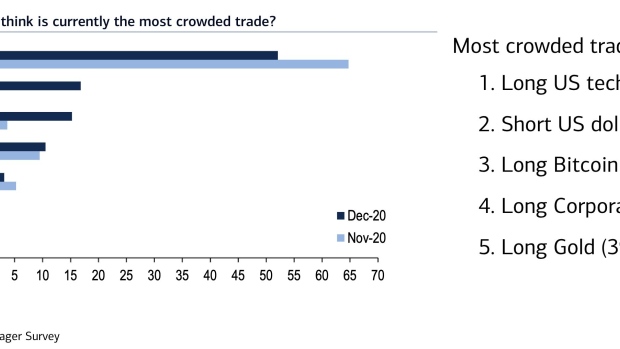

About 15% of fund managers, with $534 billion under management, surveyed by Bank of America Corp. said Bitcoin is the third-most crowded trade behind being long technology shares and shorting the U.S. dollar. The poll was taken between Dec. 4 and Dec. 10.

The world’s largest cryptocurrency is in the midst of an eye-catching rally -- it’s jumped about 170% for the year and recently hit a record high. The gains have come on the back of Wall Street taking a greater interest in digital assets, with many institutions looking to capitalize on the outsize returns in a world of rock-bottom interest rates. Guggenheim Partners LLC, for instance, recently said it might invest up to 10% of its $5.3 billion Macro Opportunities Fund in a Bitcoin trust. Meanwhile, some prominent investors, including Paul Tudor Jones, have also joined the bandwagon, citing potential inflation as a reason to own crypto even though consumer prices remain subdued.

Read more: BofA Flags Sell Signal for Stocks as Investors Rush Out of Cash

According to Philip Gradwell, the chief economist at Chainalysis, the market is being driven by North American institutional investors. The largest have come from the region, with exchanges in North America getting net inflows of Bitcoin from other areas worldwide. And the investors have been large -- exchanges are sending 19% more transfers worth $1 million or more this year while Bitcoin’s price has been above $10,000 compared with 2017 when it was trading above those levels, he said.

Seth Ginns, a managing partner at CoinFund, a New York-based investment firm, said he’s seeing a lot of interest from hedge funds, and that there’s likely to be a continued trend of broader institutional adoption next year.

Recent forays into the cryptocurrencies space by Square Inc., MicroStrategy Inc. and Massachusetts Mutual Life Insurance Co. are “laying out the groundwork for how you add Bitcoin to your balance sheet, how you should think about Bitcoin as a substitute for cash,” Ginns said on a webinar hosted by Evercore ISI Tuesday. His office has received calls from pension plans, endowments, family offices and foundations.

Bitcoin rose as much as 1.9% on Tuesday to trade around $19,562. Bitcoin Cash gained more than 9%, while the Bloomberg Galaxy Crypto Index advanced as much as 2%.

©2020 Bloomberg L.P.