Mar 8, 2023

Fund of Women-Run Firms Is Beating the S&P 500 Since Launching

, Bloomberg News

(Bloomberg) -- A new exchange-traded fund is making the case that having women at the top of corporations translates into better returns.

The Hypatia Women CEO ETF (ticker WCEO) exclusively invests in companies with a female chief executive officer. So far, that strategy is paying off. Since the fund was introduced nearly two months ago, its 4.8% surge has bested the S&P 500 Index’s 2.4% climb in the same period.

“Before January 2023, there was no fund that would allow an investor to gender balance their portfolio from a leadership perspective,” said Patricia Lizarraga, CEO of Hypatia Capital and portfolio manager for WCEO. “We hope that by shining a spotlight on the performance of American public companies with women CEOs, we can increase the percentage of woman CEOs in the United States in all asset classes.”

The outperformance comes at a time when many women are ditching the workforce in response to burnout, a lack of advancement opportunities and inadequate support in juggling personal and professional duties. Despite these challenges, women gained 34 seats on the boards of S&P 500 companies in the first two months of the year for the strongest annual start since at least 2019.

Read More: Women in Tech Are Forever the ‘Adults,’ Rarely CEO: Beth Kowitt

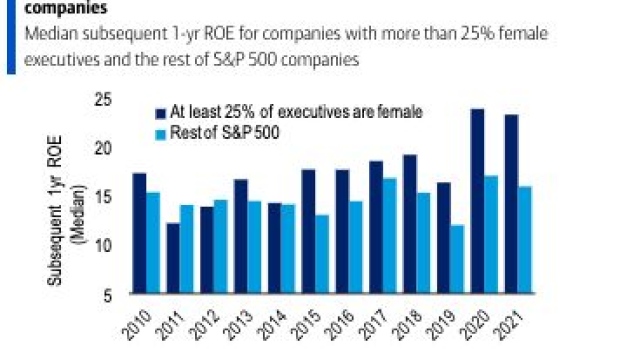

Return on equity for the following year has been higher for companies with over 25% female executives — compared to the rest of the S&P 500 — in nine of the past 10 years as of 2021, according to Bank of America.

Existing ETFs with similar mandates to advance gender equity have had mixed results as many don’t go as far as WCEO in seeking out firms with women at the highest organizational levels. The $199 million SPDR MSCI USA Gender Diversity Index ETF (SHE), which is the largest of such funds, has gained about 3% so far this year, compared with a 3.8% advance for the S&P 500. Impact Shares’ $34.5 million YWCA Women’s Empowerment ETF (WOMN), designed to invest in companies with strong policies on gender equality, is up 4.3% year-to-date.

Even with better returns, Hypatia is still hoping to raise more capital for its ETF. Previous attempts at socially-targeted funds saw those products struggle without seed money from an endowment or other big institution.

“We are at $1.6 million in AUM, a tiny fraction of other funds,” Lizarraga said. “We will feel successful when business leaders and social influencers that care and talk about equality begin to invest their portfolios accordingly.”

The lack of funding can be remedied by meaningful outperformance, according to Bloomberg Intelligence. Despite the bevy of research pointing to better performance for woman-led firms, these funds still have something to prove in order to garner assets. Top holdings in WCEO include Citigroup Inc. Progressive Corp. and Occidental Petroleum Corp.

“Even if there is academic research behind them, the one thing that can really help products like this survive and thrive is outperformance,” said James Seyffart, a BI analyst. “A product that has a good story behind it is a recipe for success.”

©2023 Bloomberg L.P.