Feb 2, 2023

Funds Jump Into Niche Loan Market Under Scrutiny After Blow Ups

, Bloomberg News

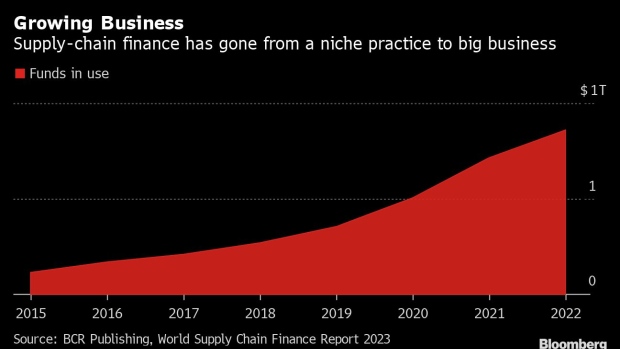

(Bloomberg) -- Asset managers and credit funds are piling into a niche funding market that’s been rocked by a string of corporate failures and scandals.

Pemberton Asset Management, Allianz SE and London-based hedge fund Fasanara Capital are among firms raising billions in funds for short-term lending, known as supply chain finance, to companies. The practice of borrowing by firms to pay suppliers early has come under scrutiny from regulators because of the way it is accounted for.

The investment case hinges on the short-term nature of the financing. Central banks have been rolling bank years of quantitative easing to combat rising prices, driving up volatility in debt markets, with the longest-dated securities hardest hit. High-yield bond funds lost more than 11% last year, according to data compiled by Bloomberg.

“We’ve seen a significant increase in demand for the strategy over the course of 2022 and a key attraction is the stability of the product,” Mark Hickey, partner and co-founder of Pemberton, said in an interview. The firm is aiming to grow the strategy to $10 billion over the next five years, he said.

In its simplest form, supply-chain finance allows companies to keep hold of their cash for longer by having a bank or another lender pay their supplier bills early for them. The transaction is effectively a loan that the company pays back later. The early payment to the supplier is discounted and the lender profits from that margin.

Fans say the arrangements benefit all parties in most cases. The supplier gets funds promptly, the lender takes a fee, and the buyer protects their working capital. But regulators and some investors have warned that accountancy rules allow companies using the practice aggressively to conceal the amount of debt they’re carrying.

Companies following US-based accounting rules must start disclosing this year that they use the financing. The International Accounting Standards Board is mulling similar disclosures.

Blow Ups

Supply chain finance played at least some part in the dramatic collapse of Americanas SA earlier last month. Carillion Plc became one of the UK’s largest corporate failures in 2018, with the contractor using the practice to label almost half a billion pounds of debt as “other payables.” Abengoa, a Spanish energy company, was brought close to insolvency in 2015, with supply-chain finance once again playing a large part.

At the other end of the chain, some lenders step in with cash for businesses in exchange for future income due on an account receivable, a practice known as factoring. The financial firms will pay less than the amount due on the receivable in exchange for providing the the cash upfront, profiting from the difference.

Greensill Capital ran a large supply-chain finance program for many corporates when it collapsed in 2021 after straying into making riskier loans. Greensill’s demise has left investors in funds run by Credit Suisse Group AG potentially facing heavy losses on loans made from investment vehicles marketed as low-risk supply-chain finance funds.

Investor Demand

In spite of the scrutiny and associated risks, demand from companies and investors is surging, according to Pemberton’s Hickey.

The asset manager plans to capitalize on that surge and fill the gap left by banks, which are becoming more risk averse, he said. The $17 billion investment firm will lend to sub-investment grade rated firms with a focus on the IT and food & beverage companies as part of the strategy, he added.

Meanwhile. the asset management arm of Allianz is targeting €1 billion for its second trade finance fund which launched to investors in November, according to David Newman, CIO and global head of high-yield at Allianz. The firm raised more than €500 million ($545 million) with investors for its first fund launched in 2019, he said.

The latest Allianz fund provides a combination of supply chain finance and receivables financing, Newman said. It’s positioned as an alternative to money market funds, targeting returns of around 60 basis points over cash rates and aims to achieve the same spreads on a like-for-like rating in the bond or loan market that would require the investor to invest for two or three years.

Fasanara Capital, which manages more than €4 billion, specializes in trade receivables financing and raised around €350 million late last year for bespoke funds wanting to invest in the product, the firm’s CEO Francesco Filia said in an emailed comment. The former Merrill Lynch banker, who founded the hedge fund firm in 2011, said he’s seen a surge of demand for the assets in recent months.

--With assistance from Lucca de Paoli.

©2023 Bloomberg L.P.