Jun 29, 2022

Funds Taking on BOJ Ready for a Key Look at Its Defense Plan

, Bloomberg News

(Bloomberg) -- Bond vigilantes betting on policy change in Tokyo get to see part of their target’s defense strategy for the next three months on Thursday as the Bank of Japan lays out its quarterly asset purchase plan.

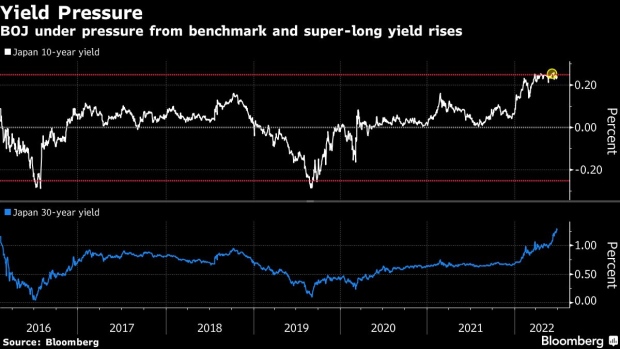

With benchmark yields bumping up against the central bank’s 0.25% cap and longer-maturity ones soaring, the BOJ is seen projecting a willingness to robustly defend its curve-control policy. It may boost purchases of so-called super-long bonds, which have seen renewed selling amid speculative attacks on the country’s bond and currency markets and rising rate-hike expectations abroad.

The central bank has already ramped up bond buying across the curve this month as 10-year yields edged above the cap and futures saw heavy losses ahead of its most recent policy decision. Overseas investors sold a record amount of Japanese bonds at that time, but the BOJ defied its critics and held firm with rock-bottom interest rates and yield-curve control.

“Foreign selling has overwhelmed domestic buying to weaken the supply-demand balance and put upward pressure on yields,” said Ataru Okumura, a strategist at SMBC Nikko Securities Inc. in Tokyo. “The probability is high for a boost in super-long zones to fend off the risk of further increase in yields and contain volatility.”

The BOJ is pushing back against normalizing policy as peers around the world race to hike rates to rein in sky-high inflation. It insists the Japanese economy still needs support and that inflation in the country requires firmer wage growth to become stable and enable a policy shift.

But foreign investors are lining up to take advantage of what they see as a policy mistake, shorting Japan’s bonds on the premise the BOJ will soon be forced to change tack. Complicating its approach, which keeps rates pinned to the floor even as foreign ones climb, the yen has sunk to a 24-year low, ratcheting up the pressure as householders and many businesses cry foul.

The Big Japan Short Is Back for Hedge Funds Betting Against BOJ

In the past, the BOJ took a more lenient stance on longer-dated bonds where higher yields are generally favorable for key investors like pension funds and life insurers. But it is also dealing with another side-effect of its unprecedented purchases -- a dysfunctional bond market.

An attack on the futures market disrupted their relationship with underlying cash bonds, weakening their usefulness as a hedge and leading to signs of lower demand and liquidity. That has exacerbated the rise in yields in areas outside the BOJ’s control, steepening the curve to levels that may be beyond its comfort zone.

“The BOJ has in the past allowed the curve steepening on the view that the impact on the real economy from super-long yields is relatively limited, but it may strengthen intervention gradually to fix an excessive distortion in the curve,” wrote Noriatsu Tanji, chief bond strategist at Mizuho Securities in a note. “Chances are high for an increase in bond buying of maturities over 10 years for the third quarter.”

The BOJ will release its purchase plan -- giving details of amounts and frequencies for key maturities -- at 5pm Thursday. It raised the amounts for maturities between one and 10 years and increased the frequency for super-long purchases in its April-June plan.

Still, there is always a chance of little change, with the central bank choosing to rely on ad-hoc additional purchases depending on market conditions, according to Katsutoshi Inadome, a strategist at Mitsubishi UFJ Morgan Stanley Securities in Tokyo.

“Since the BOJ is successful in defending the most important priority of capping 10-year yield at 0.25%, there is no need to make changes,” he said. “If super-long yields keep rising and with a fast pace, the BOJ will likely just respond with unscheduled purchase operations.”

©2022 Bloomberg L.P.