Jun 19, 2019

Futures Show Quarter-Point Fed Rate Cut Fully Priced in for July

, Bloomberg News

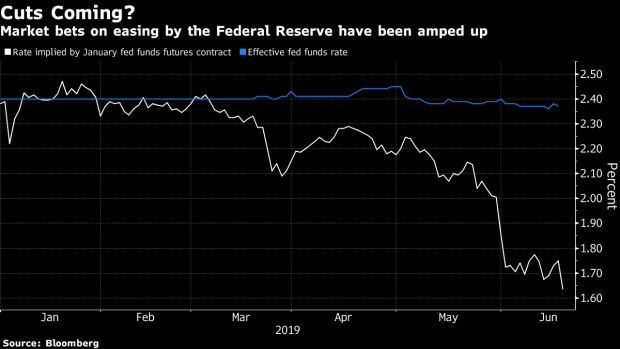

(Bloomberg) -- Bond traders are virtually certain that the Federal Reserve will ease policy as soon as next month after the central bank indicated a readiness to cut rates for the first time in more than a decade to sustain the U.S. economic expansion.

The rate implied for the July 31 Fed decision dropped by 7 basis points after Wednesday’s policy statement to about 2.06%. That suggests about 31 basis points of rate cuts by then. The January 2020 fed funds futures contract implies close to 75 basis points of easing by the end of 2019.

In his post-meeting press conference, Fed Chairman Jerome Powell said that while the economy has performed reasonably well, many committee members see that the “the risk of less favorable outcomes has risen.” The chairman also said a rate cut would depend on incoming data and the risk picture.

To contact the reporter on this story: Alexandra Harris in New York at aharris48@bloomberg.net

To contact the editors responsible for this story: Benjamin Purvis at bpurvis@bloomberg.net, Mark Tannenbaum

©2019 Bloomberg L.P.