Jul 23, 2021

Stocks hit record as blowout profits hearten bulls

, Bloomberg News

No surprise markets are choppy at this time: Starlight Capital's Dennis Mitchell

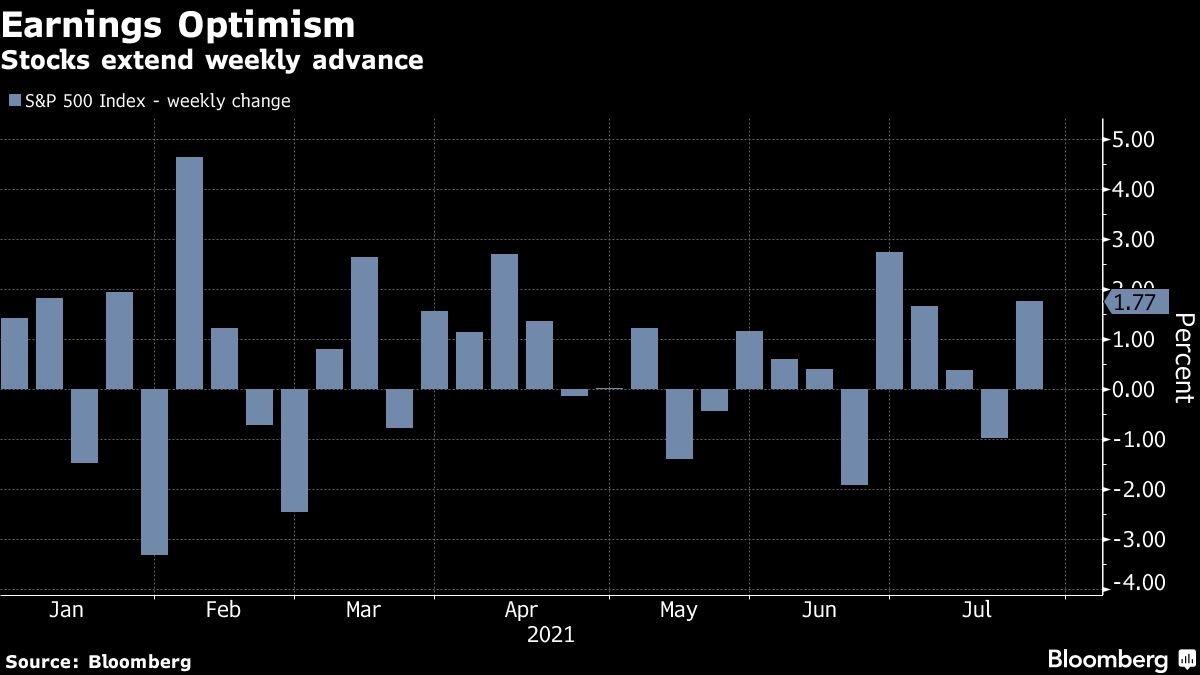

Another raft of blockbuster corporate profits pushed stocks to a record at the end of a week that started with concern about a peak in earnings and a coronavirus resurgence.

About 87 per cent of the S&P 500 companies reporting results so far this season have beaten Wall Street estimates, according to data compiled by Bloomberg. Twitter Inc. and Snap Inc. led a rally in social-media firms as sales blew past forecasts, while American Express Co. jumped after adding a record number of new customers to its tony Platinum card in the second quarter.

After this week’s gains in equities, the S&P 500 is now up 97 per cent from the depths of the pandemic. Though the rapid spread of the delta variant has sown volatility, several investors are betting that a robust economic recovery will fuel corporate America -- even with threat of higher inflation. For Evercore ISI’s Chairman Ed Hyman, retailers have more power than ever to pass on higher prices to consumers, and that will spur earnings growth in the quarters ahead.

“Earnings are reflecting an incredible snapback in economic activity,” said Jeffrey Kleintop, chief global investment strategist at Charles Schwab & Co. “Concerns that stocks are overvalued are less potent here in terms of a threat to the market simply because earnings are rising at fast clip.”

For Angelo Kourkafas, investment strategist at Edward Jones, the strong start of the second-quarter earnings season has allowed investors to look through the uncertainties. The “buy-the-dip mentality is alive and well,” he added.

Other corporate highlights:

- Honeywell International Inc.’s profit topped estimates as its aerospace and energy businesses started to recover.

- Schlumberger, the world’s biggest oilfield services provider, reported better-than-expected earnings and revenue.

- Intel Corp. Chief Executive Officer Pat Gelsinger struck a bullish tone about the chipmaker’s prospects for the rest of the year.

- Kimberly-Clark Corp. trimmed its annual forecast, saying inflation and slowing toilet paper demand are hurting results.

Some of the biggest Chinese firms listed in the U.S. slumped as concerns surrounding further regulatory scrutiny deepened. The Nasdaq Golden Dragon China Index had its longest stretch of weekly losses since May 2019, while ride-hailing giant Didi Global Inc. tumbled.

These are some of the main moves in markets:

Stocks

- The S&P 500 rose 1 per cent as of 4 p.m. New York time

- The Nasdaq 100 rose 1.1 per cent

- The Dow Jones Industrial Average rose 0.7 per cent

- The MSCI World index rose 0.6 per cent

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at US$1.1772

- The British pound fell 0.1 per cent to US$1.3750

- The Japanese yen fell 0.4 per cent to 110.55 per dollar

Bonds

- The yield on 10-year Treasuries was little changed at 1.28 per cent

- Germany’s 10-year yield was little changed at -0.42 per cent

- Britain’s 10-year yield advanced two basis points to 0.58 per cent

Commodities

- West Texas Intermediate crude rose 0.2 per cent to US$72.03 a barrel

- Gold futures fell 0.2 per cent to US$1,805.60 an ounce