May 21, 2018

Futures Tip Mixed Asia Stock Open; Dollar Retreats: Markets Wrap

, Bloomberg News

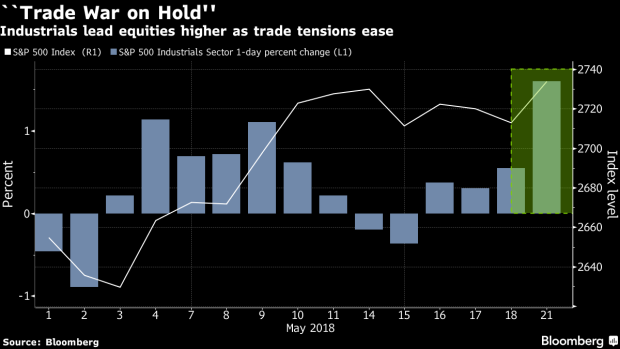

(Bloomberg) -- Asian stock futures tipped a mixed start Tuesday after U.S. shares ended higher on easing trade tensions. The dollar surrendered gains while Treasuries were little changed.

Japanese futures were higher as were those on Chinese equities after news that China is considering removing limits on how many children a family can have. Equity-index futures in Australia and Hong Kong fell. Major U.S. equity gauges were higher from start to finish. The greenback ended Monday lower, as investors assessed prospects for Sino-American trade talks. West Texas crude climbed to the highest since November 2014.

While the easing protectionist tensions offered some respite to traders as they grapple with the impact of rising U.S. interest rates and a stronger dollar, this week is loaded with risk events. The Federal Reserve and European Central Bank are releasing their latest meeting minutes, and there is a slew of debt sales from the U.S. On the geopolitical front, U.S. President Donald Trump meets South Korea President Moon Jae-in in Washington to coordinate their approach to North Korea, while Brexit negotiations are ongoing.

Elsewhere, emerging-market currencies continued to come under pressure, with Turkey’s lira falling almost 2 percent. In Europe, Italian stocks sank and bond yields soared amid growing concern over the populist coalition’s fiscal plans. Even so, contagion to the euro was limited, as the currency nudged higher after five days of declines.

Terminal users can read more in Bloomberg’s Markets Live blog.

These are some key events to watch this week:

- Brexit negotiations resume in Brussels Tuesday, and South Korea’s president visits Washington to discuss North Korea.

- Also Tuesday, Facebook Chairman and CEO Mark Zuckerberg is to be questioned by the European Parliament on his company’s use of personal data.

- The Federal Reserve releases minutes of the central bank’s May 1-2 meeting on Wednesday; U.S. new home sale also released as are euro-area and Japan PMIs.

- Thursday sees the Bank of England Markets Forum at Bloomberg London. Speakers include BOE Governor Mark Carney and New York Fed President William Dudley.

- At the St. Petersburg Forum Friday, Russian President Vladimir Putin and French President Emmanuel Macron, IMF Managing Director Christine Lagarde, and Japan Prime Minister Shinzo Abe participate on a panel moderated by Bloomberg News Editor-in-Chief John Micklethwait.

- Also Friday, European Union finance ministers discuss the latest on Brexit talks, in Brussels.

These are the main moves in markets:

Stocks

- Futures on the Nikkei 225 Stock Average rose 0.2 percent in Singapore.

- FTSE China A50 futures climbed 0.3 percent.

- Australia’s S&P/ASX 200 Index futures fell 0.2 percent.

- Hang Seng Index futures declined 0.2 percent.

- S&P 500 Index futures fell less than 0.05 percent as of 7:10 a.m. in Tokyo. The S&P 500 rose 0.7 percent Monday.

Currencies

- The Bloomberg Dollar Spot Index dipped 0.1 percent Monday.

- The euro was steady at $1.1791 early Tuesday.

- The British pound was at $1.3433, near the low for the year reached Monday.

- The Japanese yen was little changed at 111.02 per dollar, around its weakest since January.

Bonds

- The yield on 10-year Treasuries was little changed at 3.0596 percent.

Commodities

- West Texas Intermediate crude gained 0.4 percent to $72.49 a barrel, climbing for a second day.

- Gold was steady at $1,292.57 an ounce.

- LME spot copper rose 0.3 percent to $6,844.25 a metric ton.

To contact the reporter on this story: Andreea Papuc in Sydney at apapuc1@bloomberg.net

To contact the editor responsible for this story: Christopher Anstey at canstey@bloomberg.net

©2018 Bloomberg L.P.