Oct 3, 2022

FX Traders Relish Volatile Markets After Years in the Doldrums

, Bloomberg News

(Bloomberg) -- Scary times in currency markets mean boom times for the bankers that companies turn to in order to manage foreign-exchange risk.

“Clients really need FX,” said Carlos Fernandez-Aller, who oversees a team of more than 160 as head of FX and emerging-market macro trading at Bank of America Corp. “It has been up in activity which has been very lucky for us,” and there’s little sign that volumes are going to abate down any time soon, in his view.

The past few weeks has stirred the kind of activity in FX that many of those involved in trading nowadays have never even seen, at least within major developed markets. The dollar is, by some measures, near an all-time high. Sterling has been on a wild ride that took it to a record low. Japan’s government has been diving in to prop up the yen for the first time in decades, joining a swath of other countries that have been intervening.

And while the seismic ructions of the past few weeks have been particularly notable, that’s simply part of a bigger shift that’s been taking place over the last year in particular as central banks have jacked up interest rates in response to inflation risks. Years of near-zero borrowing costs from the Federal Reserve and other major peers helped suck volatility out of many markets, but that’s now being reversed and those with exposure are looking to protect themselves.

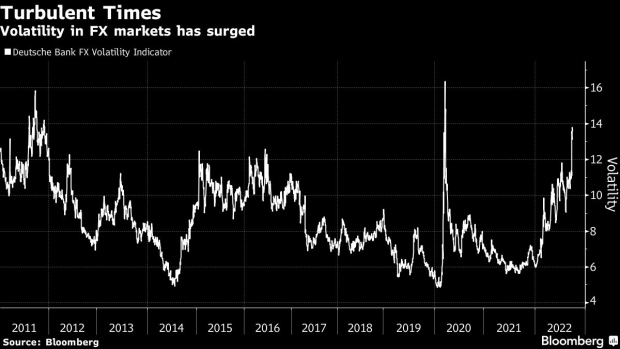

Movements in the yen and sterling have been particularly notable, but turbulence is up across FX markets. A Deutsche Bank AG gauge of expectations for volatility that draws on option-market pricing has climbed in the past week to levels last witnessed at the height of the Covid panic in early 2020. And before that it was last at these levels back in 2011 amid the fallout from the euro-area debt crisis.

These swings have given a fillip to trading sales across Wall Street, but are particularly opportune for Fernandez-Aller, who has been working to bolster Bank of America’s foreign exchange and emerging markets trading business since he was hired around two years ago. He came to the firm after more than two decades at Goldman Sachs Group Inc., where he traded structured credit, fixed income, equities and currencies.

Since then Fernandez-Aller has worked to strengthen the bank’s FX and emerging markets business, which had fallen behind peers in terms of performance.

“We developed new trade lines and products at a very lucky time,” Fernandez-Aller said in an interview last week at Bloomberg’s New York headquarters.

Upon joining BofA, Fernandez-Aller was tasked with combining FX and EM trading, which were previously two separate groups. The model mirrors that of his former employer, Goldman, as well as JPMorgan Chase & Co, the biggest US bank.

By bringing global FX and EM together, the bank is able to save on costs and also use capital more efficiently, according to Fernandez-Aller. And it also helps provide an edge in putting traders where they’re needed most.

“EM is very popular and everyone wants to trade it, but sometimes it’s not. It’s very cyclical,” Fernandez-Aller said. “When you need to put people to trade the euro you can move them there. It’s efficient and worked very well.”

Having traders that are familiar with EM-style volatility can also be beneficial when things get a bit crazier in usually more-staid developed markets -- which is what’s been happening lately.

“When you trade EM it gets you ready to trade the pound,” he said. “Because if you have traded all your life the euro and you are used to 6% volatility and that goes to 15%, you are lost. If you are trading in Brazil 15% it’s just Tuesday.”

©2022 Bloomberg L.P.