Jun 10, 2023

GameStop Needs Ryan Cohen More Than Ever to Maintain Meme Status

, Bloomberg News

(Bloomberg) -- GameStop Corp.’s revolving leadership door and an unclear strategy to compete in the video-game retail industry has puzzled Wall Street analysts. For its legions of retail traders, however, what matters most is Ryan Cohen.

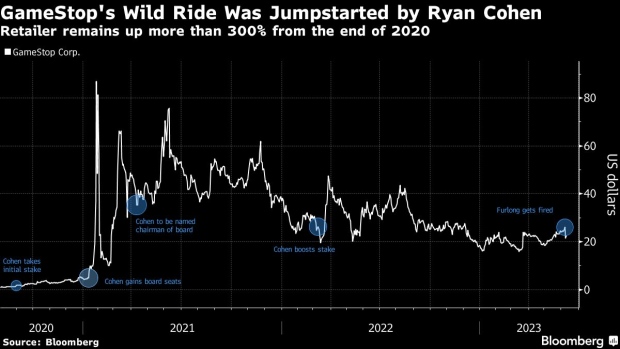

Its newly appointed executive chairman, who founded Chewy before PetSmart bought it, helped spark a more than 2,000% surge in GameStop in early 2021, and now has formal oversight of capital allocation and management. His task is formidable, as the stock’s stratospheric rise — up 382% since the end of 2020 — contrasts with lackluster sales and a hefty valuation that’s keeping traditional investors away.

“GameStop has taken on an almost mythological quality — it’s no longer about earnings or profit or revenue, it’s a story about a wild party where everyone made and lost a lot of money,” said Peter Atwater, an adjunct economics professor at William & Mary in Williamsburg, Virginia. “It’s less about what exists today than the potential that folks ascribe to Ryan Cohen and what he might be able to do with it.”

GameStop has gone through four permanent chief executive officers in less than six years, with Matt Furlong, the most recent to helm the company, terminated on June 5. It’s also on its third finance chief since 2021. The string of changes has cast an already skeptical analyst base to question what’s next, after quarterly results disappointed again and the company’s business model remains challenged.

GameStop Drops Most in Two Years After CEO Ouster, Sales Miss

GameStop has been profitable in just two quarters since Cohen’s first disclosed his initial stake in August 2020. Its latest annual revenue of $5.9 billion is largely unchanged since then and remains well below its 2016 peak of $9.4 billion.

On Wednesday, the company reported first-quarter sales that fell 10% from a year earlier, and while earnings per share met expectations, that was driven by cost cuts. Investors seeking clarity on its strategy have been disappointed given the retailer hasn’t taken analyst questions on an earnings call since late 2020 — and it outright canceled Wednesday’s.

Efforts to reach GameStop and Cohen for comment weren’t successful. An email message to GameStop’s investor relations wasn’t returned and the phone number listed on its press releases wasn’t in operation.

Investor Idol

Cohen co-founded pet retailer Chewy before selling it for $3.4 billion in 2017 after successfully taking on the likes of Amazon and bucking concerns the company would fail like Pets.com.

The billionaire became an idol to amateur investors after he gained a seat on GameStop’s board in January 2021. He planned to borrow from the model he implemented at Chewy to turn GameStop around. His popularity grew with tweets hitting back at critics, and his followers then snapped up shares of any company he touched.

Bed Bath & Beyond Inc. grabbed the meme stock baton — after Cohen took a stake — before ultimately filing for bankruptcy in April and wiping out millions for retail traders. Cohen dumped his shares and options in August 2022, pocketing $68.1 million in profit.

Individuals also followed Cohen into investments in Nordstrom Inc. and Alibaba Group Holding Ltd. Cohen urged Alibaba to ramp up share buybacks and was said to have bailed on plans to nominate a pair of candidates for Nordstrom’s board just months after building a stake.

The exodus of former Amazon.com Inc. executives poached by GameStop, like Furlong, may be a critical point in the evolution of the company. Cohen is now the face of the company that also counts him as its largest investor. He also has the full support of the retail crowd that often refers to him as “Papa Cohen.”

Retail Buying

Devout retail investors have net bought about $925 million worth of GameStop shares since Cohen’s initial position was revealed, according to Vanda Securities data.

“Loyalty among the retail cohort has remained and we’re not seeing anything in the data to suggest that this is about to change anytime soon,” said Lucas Mantle, data science analyst at Vanda.

Most of the dozens of other stocks that surged during the meme mania have flamed out, including clothing retailer Express Inc., headphone maker Koss Corp., and BlackBerry Ltd. All three have fallen more than 75% from their respective peaks, while a basket of 35 meme stocks tracked by Bloomberg is down about 80% from a 2021 high.

On the flip side, GameStop carries a market capitalization of $6.9 billion with fundamentals that Wall Street sees as far removed from its current business. The stock is holding onto nearly 1,600% gains from August 2020 when Cohen disclosed his stake, outperforming the benchmark Russell 3000 Index.

To be sure, GameStop’s balance sheet is superior to most other companies prized by retail traders. It took advantage of the soaring stock price to raise cash, clearing out its debt load, and building a $1.3 billion pile of cash and equivalents.

Even with the cash stockpile, its unclear strategy and leadership structure as well as a cagey relationship with Wall Street have drawn questions surrounding its future and ability to deliver value to shareholders. The lack of a clear direction and the way GameStop fired its chief executive officer without mentioning his name in the release will hurt any search for new executives, said Michael Pachter, an analyst at Wedbush Securities.

“Who’s going to go work there after they fired the CEO in the manner they did?”

©2023 Bloomberg L.P.