Apr 14, 2021

GameStop rises as zero-debt plan boosts bets on turnaround

, Bloomberg News

Notable Calls: Loblaw, GameStop and Crescent Point Energy

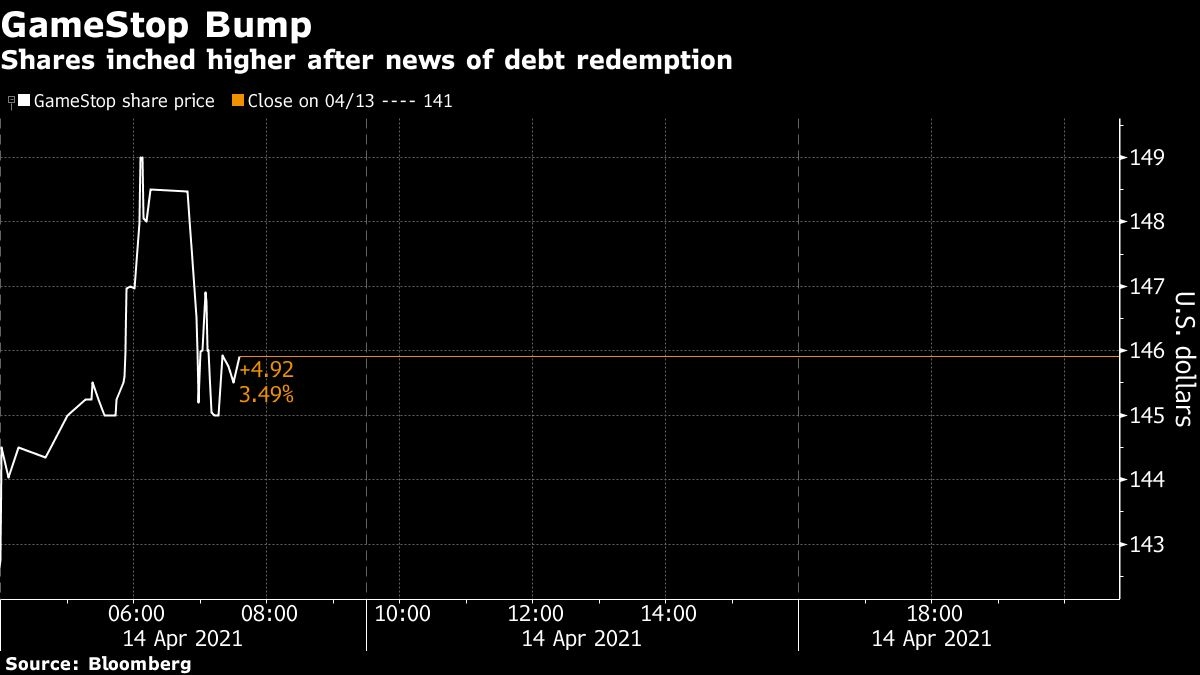

GameStop Corp. climbed Wednesday after it took a step to retire nearly all its existing debt as part of its transformation from a brick-and-mortar retailer into an e-commerce marketplace.

The stock gained as much as 23 per cent to US$173.21 at 11:30 a.m. in New York, the biggest jump in 2 1/2 weeks. The video-game retailer said late on Tuesday it’s redeeming US$216.4 million of senior notes, following a move to retire US$73.2 million in debt last month.

Roughly 10 million shares changed hands in the first two hours of Wednesday’s session, less than what has been common for the stock over the past month. While trading volume has dwindled recently, Gamestop shares are still up about 800 per cent this year, bringing the company’s valuation to more roughly US$12 billion.

The video-game retailer is in the midst of a turnaround, spearheaded by activist investor Ryan Cohen, shifting from a brick-and-mortar company and into an e-commerce marketplace able to compete with the likes of Amazon.com Inc..

Earlier this month, the company announced plans to offer as much as US$1 billion in additional shares. The extra cash cushioning, combined with fewer debt obligations may contribute to more favorable terms for the company in dealings with suppliers and partners.

“Debt retirement is what they should have focused on in the first place,” Wedbush analyst Michael Pachter said in an email. “That puts them in a very secure financial position.”

GameStop’s rally stood out from peers that have captivated retail investors as meme stocks were mixed Wednesday. While movie-theater operator AMC Entertainment Holdings Inc. climbed, cannabis stock Sundial Growers Inc. and animal-health company Zomedica Corp. dipped.

GameStop, which is based in a Dallas suburb, has been hit by the video-game industry’s shift to online distribution. The company reported disappointing fourth-quarter earnings last month.