Aug 30, 2021

Gaming Stocks Slump as China Takes Aim at Children’s Online Play

, Bloomberg News

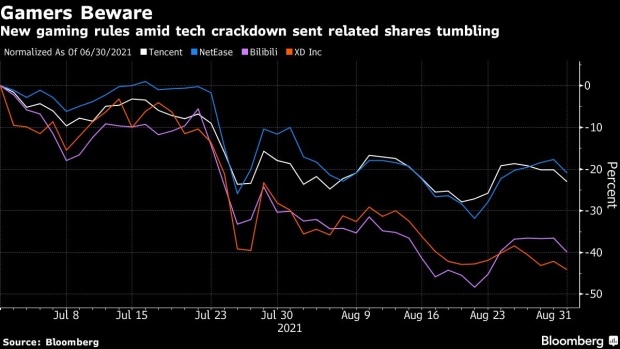

(Bloomberg) -- Gaming stocks tumbled in China and Japan as regulators in Beijing cut back the amount of time children can play online in the world’s biggest gaming market.

The Hang Seng Tech Index slid as much as 1.5%, led by shares of Bilibili Inc. and NetEase Inc., which fell in Hong Kong after declines in their American depositary receipts. The renewed selloff helped drag the city’s benchmark Hang Seng Index to the lowest level in a week, while losses spread to gaming shares in Tokyo.

“The regulatory environment is clearly continuing to pose a headwind for sentiment around China’s tech stocks,” said Bloomberg Intelligence analyst Matthew Kanterman, “It’s tough to see a light at the end of the tunnel as that requires guessing the next move by the government.”

The escalation of restrictions on gaming adds to the pain for investors in the region’s biggest technology companies, who’ve been hit by new rules from Beijing on everything from ride-hailing platforms to e-commerce to data security. The latest move has also halted a spurt of bargain hunting that had helped the sector claw back some of its losses over the past week.

Bilibili declined as much as 7.2% while NetEase slipped 4.6%. Kanterman noted that Bilibili’s customer base is skewed a bit more toward youth than that of NetEase.

Shares of food delivery giant Meituan were also swept up in Tuesday’s rout, dropping as much as 2.1% as concerns over renewed regulatory crackdowns outweighed the company’s strong second-quarter revenue beat.

China Slashes Kids’ Gaming Time to Just Three Hours a Week

The new rules will only allow gaming platforms to offer services to minors from 8 p.m. to 9 p.m. on Fridays, weekends and public holidays, according to state news agency Xinhua, which cited a release by the National Press and Publication Administration. China had previously restricted gaming hours for teens to 1.5 hours per day in 2019.

In Tokyo, Nexon Co. and Koei Tecmo Holdings Co. led Japanese video game makers lower. Nexon fell as much as 5% while Koei Tecmo dropped as much as 4.4%. Nexon received about of its 28% of its revenue from China in the last fiscal year.

Chinese gaming stocks listed in the U.S. had come under pressure on the news on Monday, with NetEase, Tencent Holdings Ltd., Bilibili and Huya Inc. ADRs all falling at least 1.1%.

The Nasdaq Golden Dragon China Index -- which tracks 98 firms listed in the U.S. that conduct a majority of their business in China -- still managed to gained 0.7% after earlier falling as much as 2.5%. Yet the gauge has dropped 29% this year, including about 47% since its record high in February.

(Updates throughout)

©2021 Bloomberg L.P.