Jul 6, 2022

Gas Crunch to Haunt Europe for Winters to Come, LNG Lobby Says

, Bloomberg News

(Bloomberg) -- Those expecting Europe’s worst energy crisis in decades to ease after this winter are going to be disappointed, according to a major gas lobby.

“We might go through the winter of 2022/23 without too much damage -- if we are lucky -- but the next winter will probably be more difficult, and the winter after,” said Vincent Demoury, the general delegate of GIIGNL, the Paris-based group of international liquefied natural gas importers.

While last winter’s milder weather left Europe with higher-than-expected gas inventories for the coming heating season, market prices are soaring on the threat of a winter fuel shortage. A prolonged cut in Russian imports and resurgent demand in China after virus lockdowns will mean replenishing Europe’s storage sites for next year will be challenging, Demoury said Wednesday at an industry gathering in London.

EU to Discuss Winter Gas Contingency Plans at Emergency Meeting

Policymakers have acknowledged the risk of an extended gas crisis. The European Commission, the EU’s executive arm, is expected to unveil later this month more detailed contingency plans for the heating season, which may include recommendations for better long-term planning in case of tougher winters and fewer alternative sources to tap.

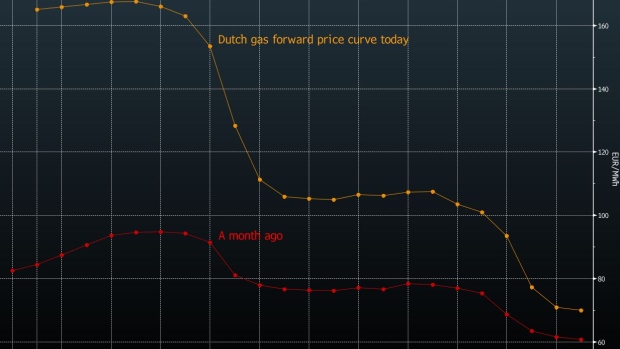

Natural gas futures for the next six months have surged on the threat Russian flows will further decline or stop altogether. But the forward price curve shows a steep drop from next summer, an indication that supplies are expected to be more plentiful as demand falls.

Global Gas Demand Growth Forecast to Falter for Years, IEA Says

“I hope it’s a short-term situation, but I think it’s a one- to three-year situation,” Jonathan Stern, a distinguished research fellow at the Oxford Institute for Energy Studies, said at Wednesday’s gathering. “We shouldn’t underestimate the effects of recession, which I think are coming big-style in Europe.”

©2022 Bloomberg L.P.