Nov 21, 2018

GE could be a US$41B problem for big American banks

, Bloomberg News

When it comes to U.S. banks’ lending risk, it doesn’t get much bigger than General Electric Co. The five biggest Wall Street firms have committed to lending at least US$3.5 billion each to the industrial giant facing concerns about the sustainability of its debt.

GE has almost US$41 billion in credit lines it can draw from, according to its latest quarterly regulatory filing. If fully tapped, the two main credit facilities would rank as the largest loans to any U.S. company that go beyond next year, data compiled by Bloomberg show. GE had used only about US$2 billion of the available credit by the end of the third quarter, leaving itself ample room to pull more if necessary.

From GE’s perspective, the unused credit is a crucial backstop as analysts voice concerns about the risk of a funding shortage. Chief Executive Officer Larry Culp has been selling assets to raise cash and is under pressure to raise more through a stock offering. The untapped credit “gives us a foundation” as the firm takes steps to reshape itself and ultimately reduce its borrowings, he told CNBC this month.

From the banks’ perspective, the possibility of a draw-down by a borrower getting shut out of other funding sources poses risks, including default if the company ultimately proves unable to manage its obligations. In debt markets, the premium demanded by investors to insure against a default has jumped, signaling the possibility of further cuts to GE’s credit rating and higher costs for new borrowings. GE was cut by the two biggest rating firms last month, ending up three grades above junk.

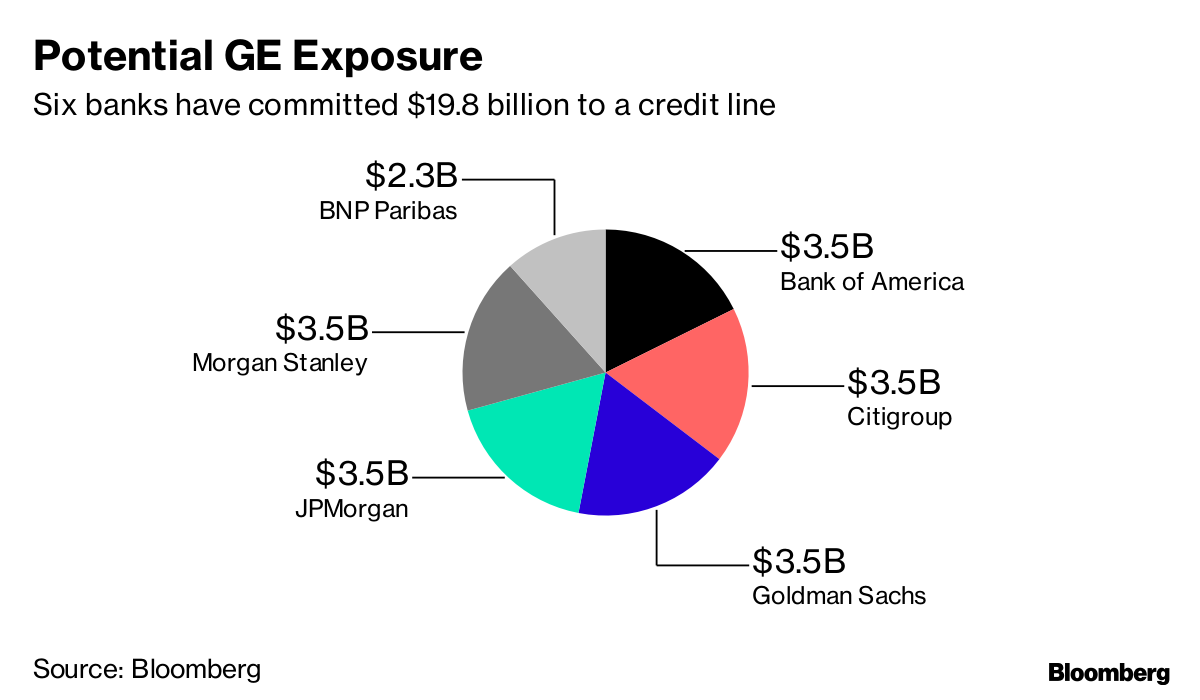

GE divided its credit facilities into three categories at the end of September. The main one includes a US$19.8 billion credit line from six banks, which expires in 2020. Then there’s a US$20 billion backup facility from 36 banks expiring in 2021. The third group is a collection of credit lines arranged individually with seven banks, expiring between February and May of next year.

Such commitments can make up an outsize chunk of a bank’s portfolio. Morgan Stanley’s share of the first GE facility amounted to 6 percent of its investment-grade lending commitments at the end of September. At Goldman Sachs Group Inc., it was 4 percent of the bank’s high-grade book.

“I’m not concerned about GE’s credit at all,” Morgan Stanley CEO James Gorman said Tuesday in an interview on Bloomberg Television. “The market over-worries. GE is a fantastic institution, they have tremendous ability to restructure.”

Spokesmen for GE and the other banks in the first credit line declined to comment.

Limiting Exposure

GE’s quarterly filing doesn’t identify the three dozen lenders in the backup facility or specify how they are splitting their commitment. JPMorgan Chase & Co. is among members of that group, according to data compiled by Bloomberg. So is Wells Fargo & Co., which isn’t one of the lenders named in the first line.

Still, there are limits to banks’ exposure. GE’s filing shows there are so-called offset provisions for firms participating in both syndicates, potentially preventing the company from tapping the same lenders twice. Also, banks can -- and usually do -- hedge themselves against losses from big borrowers by buying credit derivatives that act as insurance.

Companies typically draw down heavily on their credit lines when facing funding shortfalls. Earlier this month, California utility operator PG&E Corp. fully used its credit facility. At the time, investors worried the company might lose its investment-grade credit rating or face liability related to wildfires ravaging the state.