Hong Kong Developer Weighs Stake Sale in London Office Skyscraper Project

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Chinese mainland investors increased their portion of total turnover of Hong Kong stocks to a record daily average in April, with the latest measures to bolster the city’s position potentially boosting their purchases.

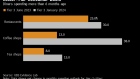

Zhao Xiaowei did what would have been unthinkable just a few years ago: He quit his Beijing barista job and returned to his northeastern rust-belt hometown for a better future.

Jan 18, 2022

, Bloomberg News

(Bloomberg) -- Update: Cruise operator Genting Hong Kong has filed to wind up the company.

Troubled cruise operator Genting Hong Kong Ltd. has filed to wind up the company, putting the spotlight on what support its lead shareholder Lim Kok Thay may provide.

The Hong Kong-based firm has been pummeled by the plunge in travel demand due to Covid-19 that has led to a string of restructurings and insolvencies among travel firms globally. It reported a record loss of $1.7 billion in May, and the latest developments come just as Hong Kong reimposes some of its strictest virus curbs since the pandemic began.

Winding up the company likely won’t have any earnings impact on the other Genting firms as there’s no cross shareholding between them. But the question some analysts have asked is whether Lim may try to bail out the firm with help from its sister companies, which could pose risks for their shares.

What’s next?

The filing at the Supreme Court of Bermuda, where the company has its registered office, is a way to get assistance safeguarding its assets. The firm “exhausted all reasonable efforts” to negotiate with its creditors and stakeholders, it said in a statement to the Hong Kong stock exchange Wednesday.

Investors will also be watching for potential resumption in the firm’s Hong Kong-listed shares, which have plunged almost 50% this month. The stock will remain suspended until further notice.

Will this affect other Genting firms?

Genting Hong Kong was established in the early 1990s when tycoon Lim wanted to diversify the business risk from his main casino resort in Malaysia. He owns a 76% stake in Genting Hong Kong. But the Genting group of companies listed in Malaysia and Singapore have no cross shareholding with Genting Hong Kong except for Lim being a common shareholder in all three. So as far as earnings go, there would be no impact on the Malaysia- and Singapore-listed Genting shares.

What are the risks then?

The worry is whether Lim would tap other parts of his Genting empire to help with any bailout or provide financial help. And he has a history of taking such steps.

He has used Genting Malaysia to conduct related party transactions previously. One example: Genting Malaysia said in 2019 that it was buying a 46% stake in Empire Resorts in New York from him. This deal caused a slump in Genting Malaysia shares. The Malaysia firm now owns a 49% stake in Empire Resorts.

Read also: Genting Malaysia Takes on Loss-Making Casino Unit in Lim Shuffle

Another concern is that Lim pledged almost his entire stake in Genting Hong Kong as collateral for loans to keep the Hong Kong firm going.

What are the other Genting empire firms?

©2022 Bloomberg L.P.