Jan 3, 2020

German Economy Struggles With Job Losses Even as Prices Pick Up

, Bloomberg News

(Bloomberg) -- Germany faced higher prices and job losses at the end of 2019, a year marked by a manufacturing slump that threatens to undermine the relatively strong consumer economy.

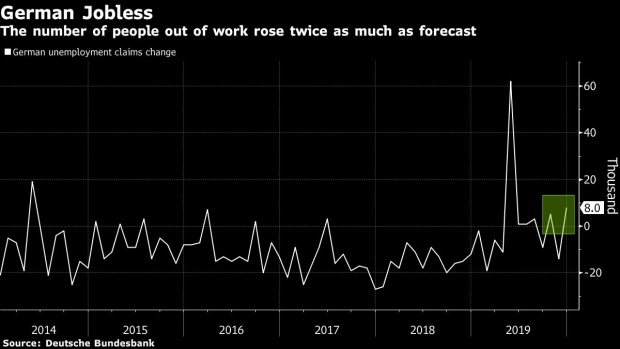

Inflation accelerated to 1.5% in December, up from 1.2% the previous month. That’s the steepest pace since June, though the rate is still well below the European Central Bank target for the euro zone of just under 2%,. Data earlier in the day showed the number of people out of work increased by 8,000, twice as much as expected.

Europe’s largest economy is at a critical point with government and consumer spending barely offsetting the worst manufacturing malaise in a decade. Amid concerns that job losses at factories will undermine household income and hurt demand for services, calls have mounted for the government to step in with fiscal stimulus.

The signals are mixed so far. While concerns over the U.S.-China trade war and Brexit have eased somewhat, companies remain nervous that trade tensions could flare up again at any time. The prospect of geopolitical shocks was highlighted late Thursday when a U.S. airstrike in Iraq, ordered by President Donald Trump, killed one of Iran’s most powerful generals and prompted an Iranian promise of retaliation.

With confidence weakened and Germany’s economically vital auto industry struggling with the shift to electric vehicles, the nation only narrowly averted a recession last year. A purchasing managers index this week pointed to the manufacturing slump worsening.

The Bundesbank’s most-recent projections show that domestic demand will increasingly be hurt by a weakening labor market. The central bank cut its 2020 GDP forecast in half and now foresees an expansion of just 0.6%.

At the same time, stronger prices are just what the ECB wants to see. French inflation also accelerated last month, to 1.6%, but such readings remain unstable and short of the ECB’s goal for the euro zone.

The central bank opted last year to cut its key interest rate to a record-low minus 0.5% and resume quantitative easing in an attempt to boost the economy. It also urged governments with fiscal space -- such as Germany -- to spend more.

So far, that call has gone largely unheard. The government argues that the economy is not in a crisis, a view backed by Bundesbank President Jens Weidmann who says government spending is already rising but that there is no need for a significant fiscal package.

--With assistance from Catherine Bosley and Tom Lavell.

To contact the reporter on this story: Paul Gordon in Frankfurt at pgordon6@bloomberg.net

To contact the editors responsible for this story: Paul Gordon at pgordon6@bloomberg.net, Brian Swint

©2020 Bloomberg L.P.