Apr 1, 2019

German factory slump leaves Euro area as global economic laggard

, Bloomberg News

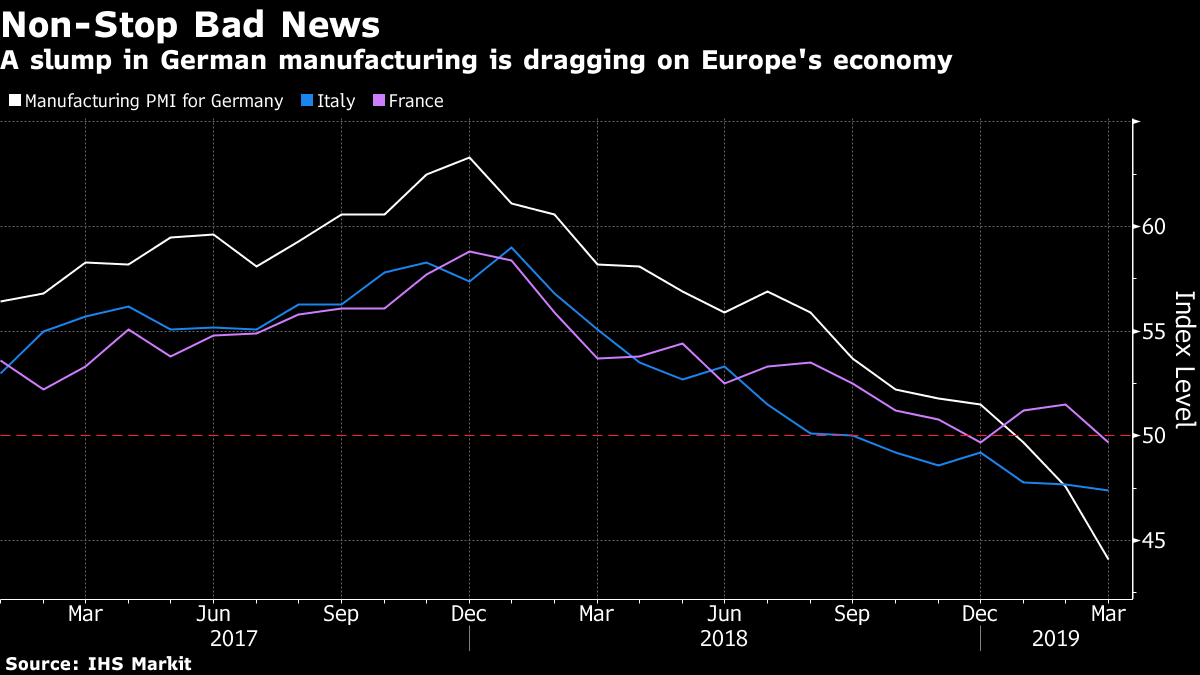

Europe’s position as the weak link in the global economy is becoming more entrenched, with a factory slump intensifying at the same time that Asia shows signs of stabilizing.

Monday saw the region hit with another round of bad news, from the worst German manufacturing performance in almost seven years to euro-area core inflation at its weakest in 11 months. Italy’s industrial contraction deepened, and a euro-wide measure is signaling multi-year lows for confidence and demand.

The bleak European picture contrasts with an improvement in Asia, where Purchasing Managers Indexes were led higher in March by China returning to expansion. In the U.S., the PMI is forecast to hold steady, while a separate gauge by the Institute for Supply Management is expected to improve.

Diverging fortunes indicate that Europe is losing the most in the global slowdown and suffering from the trade-war crossfire between the U.S. and China. The region’s difficulties are also partly homegrown, with prolonged disruption in the auto industry and the threat of a disorderly Brexit hurting confidence.

The warning signs have already forced the European Central Bank to redraw its plans for exiting stimulus measures. It’s currently working on a new round of cheap loans to banks in an effort to respond to the downturn, but that may not be enough, said Christopher Dembik, global head of macroeconomic research at Saxo Bank.

“Europe is currently the weakest point in the global economy,” Dembik said. “We got an horrible set of new data for the euro area that confirms the risk of lower growth than expected by consensus.”

The woes of the European economy have pushed investors into government bonds, sending the yield on 10-year German debt below zero for the first time since 2016. Stocks in Europe rose on Monday, following gains in Asia on the back of the China figures.

The underperformance in euro-area manufacturing was linked to order books contracting the most since the end of 2012, said IHS Markit, which produces the survey. Net job losses were recorded in Germany and Italy.

“Looking at the forward-looking indicators, downside risks have intensified,” said Chris Williamson, chief business economist at IHS Markit.

The figures will prove disappointing at the ECB, where there’s still hope that the slowdown will soon bottom out, setting up an improvement later this year. On the inflation figures, which saw core inflation slow to 0.8 per cent, policy makers may point to the late timing of Easter and a likely rebound in April.

What Bloomberg Economics Says:

“Slower headline and core inflation probably reflects the timing of Easter holidays, but this may add to concern among policy makers at the European Central Bank that a slowdown in the euro-area economy is impacting prices.”

The latest economic signs in Asia were brighter, with the factory PMI for Japan and South Korea’s PMI both rising.

The region may be benefiting from China’s stimulus and positive signals from U.S.-China trade talks. However, it’s not clear that will help the European situation just yet.

“China’s growth rate is indeed bottoming out, the export outlook can improve,” said Berenberg economist Holger Schmieding. “However, it will likely take a few months until European industry starts to notice the impact of easing trade tensions and China’s stimulus to domestic demand.”

--With assistance from Carolynn Look, Jana Randow, Enda Curran and Mark Evans