Aug 25, 2019

Germany in Uproar as Negative Rates Threaten Saving Obsession

, Bloomberg News

(Bloomberg) -- Most Germans live by the credo that saving is a virtue, but the European Central Bank’s negative interest rates risk making a mockery of the national obsession, prompting politicians to seek ways to insulate thrifty citizens and keep the burden on the country’s beleaguered banks.

Finance Minister Olaf Scholz says he’ll look into whether it’s possible to prevent German banks from charging most retail-banking clients for deposits, after such a measure was proposed by the leader of Bavaria. Lenders have rejected the idea, saying bans don’t ultimately help clients and could even destabilize financial markets.

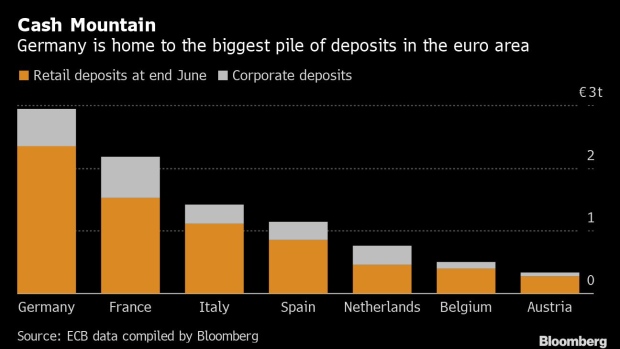

Germany’s overcrowded banking industry has long contended with sub-par profitability, but after five years of negative rates, lenders are running out of ways to offset the hit to earnings. With the country gearing up for regional elections next month, the ECB is an easy target for a country known for its risk-averse attitude to money and its habit of hording savings in checking accounts. At 2.35 trillion euros ($2.6 trillion), no other country in the euro area has a larger pile of retail deposits.

Germany’s citizens also save far more of their disposable income than most other Europeans. The country’s savings rate was around 10% in 2017, almost twice the euro-area average, according to Deutsche Bank AG. On average, Germans held more than 40% of their financial assets in the form of bank deposits in 2018.

Negative rates, which mean deposits decline over time rather than increase, “would be bad for all savers,” said Juergen Dengel, a 40-year-old civil servant from Bonn. If negative rates were introduced at his bank, he would consider withdrawing his money and using it to build a home -- even if that meant going into debt.

“This is a total political football,” said Klaus Fleischer, a professor specializing in finance at the Munich University of Applied Sciences. “People love to hear someone standing up for them when their savings melt away.”

Not everyone’s in favor of outlawing deposit charges, though. “A ban on negative rates might be attractive for savers, but then we have to also think of how we’d support unprofitable but systemically-relevant banks,” said Ingrid Arndt-Brauer, a lawmaker for the Social Democratic Party, Angela Merkel’s junior coalition partner.

The ECB itself is considering ways to relieve the burden of negative rates on banks.

Double Whammy

Negative rates are a double whammy for lenders. Euro-area banks pay more than 7 billion euros a year to deposit funds overnight with their central bank, while at the same time their income from lending is eroded. That has helped push the share prices of many European lenders to record lows and has left Germany’s Deutsche Bank and Commerzbank AG reeling from falling revenue and shrinking profitability.

Banks across Europe already pass on negative rates to corporate clients and aren’t ruling out doing the same to retail customers. In Germany, the issue has exploded onto the front pages of the country’s largest tabloid, with Bavarian Premier Markus Soeder even calling for a ban on deposits of up to 100,000 euros.

“These suggestions show how far the undesired side effects of the ECB’s negative rates stretch,” Germany’s banking lobby said in a statement, referring to the central bank’s deposit rate of minus 0.4%. Still, banks cannot ignore the market as a whole when setting their conditions -- even when rates fall below zero, the group said.

Some German retail banks already charge customers for holding as little as 100,000 euros in deposit accounts, though they have have yet to extend the policy to the bulk of their customers.

Savings Shopper

Fabian Rodenbach, a 40-year-old teacher from Cologne, already shops around for the best rates. “For years now, I have also been putting my money into savings accounts in other European countries,” he said.

Mittelbrandenburgische Sparkasse said it spent 3.65 million euros last year to park funds at the central bank and other lenders. At the same time, the company collected only 840,0000 euros from corporate customers and municipalities by charging a negative interest rate of 0.4% on deposits of more than 2.5 million euros.

Any step to limit banks’ options to deal with negative rates would mark an escalation in tensions between the ECB and parts of the German political establishment, which have long criticized the central bank’s loose monetary policy. In 2016, then-Finance Minister Wolfgang Schaeuble, who currently presides over the Bundestag, pinned some blame for the rise of the populist Alternative for Germany party on the ECB.

It’s far from clear whether the ban that Soeder suggested would be possible to implement, said Fleischer, the professor in Munich. Scholz said the legality of such a measure would be among the first things his ministry will examine.

--With assistance from Piotr Skolimowski.

To contact the reporters on this story: Nicholas Comfort in Frankfurt at ncomfort1@bloomberg.net;Stephan Kahl in Frankfurt at skahl@bloomberg.net;Birgit Jennen in Berlin at bjennen1@bloomberg.net

To contact the editors responsible for this story: Dale Crofts at dcrofts@bloomberg.net, ;Daniel Schaefer at dschaefer36@bloomberg.net, Andrew Blackman, Chris Reiter

©2019 Bloomberg L.P.