Nov 24, 2020

Germany’s DAX Will Get Bigger and Stricter After Wirecard Fiasco

, Bloomberg News

(Bloomberg) -- Germany’s DAX benchmark is about to undergo the biggest makeover since its inception in 1988.

Index operator Qontigo, a unit of Frankfurt-based Deutsche Boerse AG, plans to increase the number of members to 40 from 30 and impose new quality criteria on both existing and prospective members.

The changes follow a four-week long market consultation in which more than 600 participants voted in favor of proposals that include new rules requiring members to have staffed audit committees and post quarterly statements, as well as audited annual results, with a fast exit for those failing to do so. To join, new members will need to show they’ve been profitable for two years.

While the DAX’s composition was long governed by rankings based on market cap and traded volume, the index owner plans to drop the volume ranking, leaving market cap and the new qualitative criteria as the main tests for entry.

The push to reform index rules, which had remained mostly unchanged for the past three decades, was sparked by the high-profile case of Wirecard AG, the fraudulent fintech that was a DAX member for two years despite repeated allegations of accounting irregularities. When it collapsed in June, pressure to overhaul the index mounted as existing rules didn’t allow for the benchmark’s first-ever insolvent member to be ejected right away.

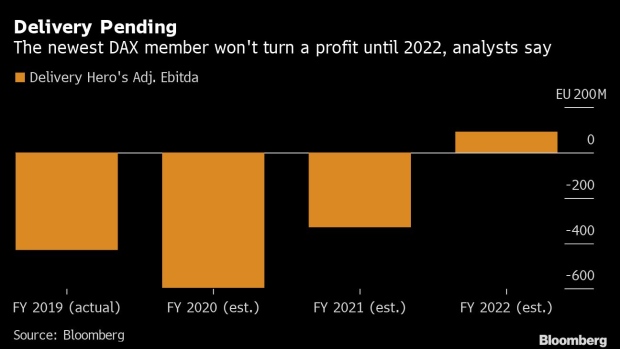

Delivery Hero SE joined the DAX to replace Wirecard, and some investors expressed unease about the fact that the Berlin food delivery firm had never reported an annual profit. Had the new rules already been in place, it would not have been eligible to join.

Inclusion in benchmark indexes is becoming more important for companies in a financial landscape increasingly dominated by passive investment funds. Bank of America Corp. strategists predict that equity assets in index-tracking funds will surpass actively managed portfolios in August 2021. About 14 billion euro in exchange traded funds track Germany’s DAX Index, data compiled by Bloomberg shows.

©2020 Bloomberg L.P.