Sep 23, 2022

Ghanaian Banks Would Bear the Brunt of a Local-Debt Restructure

, Bloomberg News

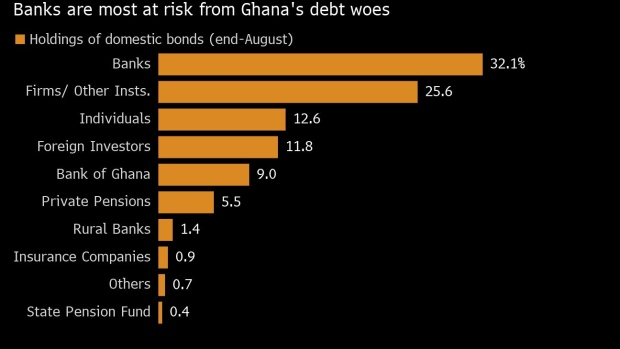

(Bloomberg) -- Ghana’s banks would be the main casualty if the government follows through on a proposal to restructure domestic debt.

The West African nation’s lenders held 32% of outstanding government bonds at the end of August, the biggest chunk among investor groups, according to the Central Securities Depository Ghana Ltd.

Ghana is considering reorganizing part of its $19 billion of local debt in order to secure a loan from the International Monetary Fund. The changes may impose losses in capital and interest payments on investors, according to people familiar with the matter.

©2022 Bloomberg L.P.