Aug 7, 2019

Glencore's Congo Stoppage Offers Jolt to Ailing Cobalt Market

, Bloomberg News

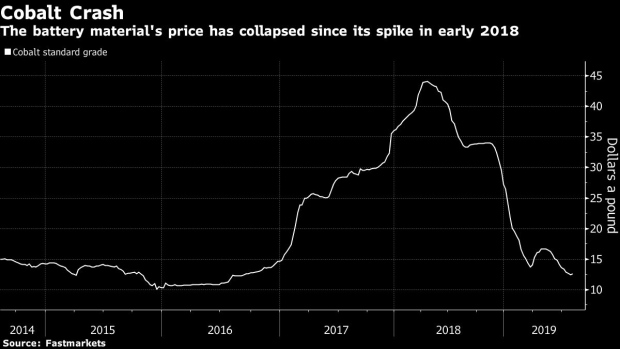

(Bloomberg) -- Glencore Plc’s plan to halt a fifth of the world’s cobalt production is set to offer some respite for prices of the battery material that cratered in the past year on a supply glut.

The mining giant is set to close the Mutanda copper-and-cobalt facility in the Democratic Republic of Congo at the end of this year on lower prices and as costs at the project increased, according to a person familiar with the situation. Shares in major Chinese cobalt companies rallied on Wednesday. China Molybdenum Co., which also mines in the African nation, rose the most in four years in Hong Kong.

“This should lift sentiment in the global cobalt market,” Daniel Chen, analyst at CRU Group said by phone from Guiyang in southern China. “Previously, consensus was that cobalt would be very oversupplied for two or even three years ahead, but now the market will pay more attention to risks in the DRC, and risks on the supply side.”

Cobalt’s been on a two-year rollercoaster as the industry adjusts to an era of expanding demand for the material for batteries used in electric vehicles. Prices are down more than 70% since April last year, after a buying frenzy on concerns of a shortage gave way to an unexpectedly strong wave of new supply. The DRC produces more than two thirds of the world’s cobalt.

Mutanda will be put on so-called care and maintenance, according to a person familiar with the situation who asked not to be identified as the plans haven’t been made public. It was already expected that the mine would produce half as much copper this year after it mined more complicated ores that raised costs. Glencore is expected to outline an overhaul of its key African units when it releases first-half results on Wednesday.

“Chinese producers are likely to gain market share on the back of the mine closure,” Gerry Alfonso, director of international business department at Shenwan Hongyuan Group Co., said by email.

Mutanda produced about 27,000 tons last year out of a global total of around 135,000 tons, according to trading firm Darton Commodities. A second Glencore unit in Congo separately lowered its guidance for 2019 in a Tuesday announcement. Katanga Mining Ltd. expects to produce 14,400 tons of cobalt this year, against a previous forecast of 26,000 tons.

Market reactions in Hong Kong and mainland China:

- China Molybdenum climbs as much as 17% in Hong Kong on Wednesday, the biggest intraday gain since 2015. Stock rose by 10% daily limit in Shanghai.

- Zhejiang Huayou Cobalt Co., the world’s biggest refiner, and Nanjing Hanrui Cobalt Co. both also gain by 10% daily limit.

--With assistance from Amanda Wang.

To contact Bloomberg News staff for this story: Martin Ritchie in Shanghai at mritchie14@bloomberg.net

To contact the editors responsible for this story: Phoebe Sedgman at psedgman2@bloomberg.net, Keith Gosman

©2019 Bloomberg L.P.