Feb 8, 2023

Global Banks Seek to End Drought in China Property Debt Sales

, Bloomberg News

(Bloomberg) -- Global investment banks including JPMorgan Chase & Co. and UBS Group AG are renewing efforts to gauge investor interest in Chinese developer bond sales, in hopes of revitalizing a key business following a yearlong deal drought.

Hong Kong-based debt capital market bankers have been approaching the investors, encouraged by the recent return to the primary market by major conglomerate Dalian Wanda Group Co.’s property arm after a 16-month absence, according to people familiar with the matter.

The developers that bankers are testing investor appetite for include Country Garden Holdings Co., Hopson Development Holdings Ltd., Road King Infrastructure Ltd. and Yanlord Land Group Ltd., said the people who requested anonymity discussing private matters. JPMorgan, UBS, Credit Suisse Group AG, Guotai Junan International Holdings Ltd. and HSBC Holdings PLC are among those initiating such offerings, they added.

While the pitching frenzy is part of a global trend following a broader market recovery, the pressure is especially acute on China-oriented investment banks after the country’s unprecedented property crisis caused a once-lucrative business to vanish. But the bankers face an uphill battle, because borrowing costs remain prohibitively expensive for most Chinese builders even after Beijing’s sweeping rescue measures triggered a strong rally.

Investment banks are urging the borrowers to seize the issuance window as much as they can, said a Hong Kong-based debt capital market banker with a major Chinese brokerage. They also listed uncertainties over how sustainable the recent secondary-market rally and Beijing’s policy support may be as reasons, said the banker who also asked not to be named.

UBS and HSBC declined to comment. Credit Suisse, Guotai Junan, JPMorgan, as well as the developers mentioned above didn’t respond to requests for comment.

Once one of the hottest trades in the world, Chinese developers’ dollar bonds have imploded in the last two years as a government crackdown on high debt and a housing slump caused yields to surge, defaults to break records and fundraising to dry up.

Dollar note issuance by Chinese real estate firms fell 60% to $18 billion last year, the lowest since 2016, Bloomberg-compiled data show. However, the bulk of the deals were notes issued by cash-strapped builders to replace maturing debt, an exercise known as a distressed exchange offer.

The dearth of new offerings from the sector was a key part of the broader plunge in China-related investment banking revenues last year, resulting in the worst payouts at Wall Street firms in Asia since the global financial crisis and prompting big players from HSBC to UBS to slash headcounts.

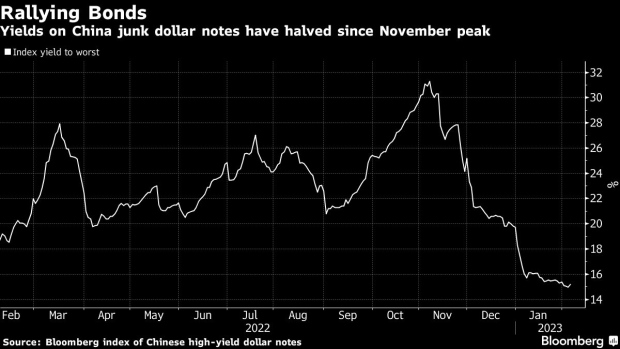

A turnaround has emerged since November, when Beijing stepped up efforts to salvage the ailing housing market as economic growth overtook Covid controls as policymakers’ top priority. Chinese junk dollar bonds, dominated by those from developers, have rallied for a record 13 straight weeks since then, pushing average yields down to around 15% from a record 31%, according to a Bloomberg index.

The momentum gained further traction last month, when Wanda returned to the market with a $400 million deal, a rare offering at that time that stoked hopes for a wider recovery in dollar debt sales. The company issued another $300 million note this week.

However, analysts have cautioned that Wanda’s property exposure is largely confined to commercial real estate, rather than the hardest hit residential sector, which makes it a safer bet and less comparable to China’s distressed home builders.

And even for Wanda, one of the country’s financially healthier private firms, the 12.375% yield that it priced both of its latest two deals at marked a record for itself, making the prospects of securing cheaper financing even dimmer for its weaker peers.

Many developers approached by bankers so far remain cost sensitive and prefer to wait until yields drop further, according to people familiar with the discussions.

Other hurdles to the banks’ efforts include China’s much cheaper local credit market, where regulators have expanded a program to help developers issue bonds with state guarantees, as well as a steady increase in stock financing by stronger builders like Country Garden.

“Most issuers still have the benefit of time to wait out a bit more as investor demand is weak still,” said Eddie Chia, portfolio manager at China Life Franklin Asset Management Co. “The primary market normalization still depends on sales recovery and company operations.”

--With assistance from Emma Dong.

©2023 Bloomberg L.P.