Oct 5, 2022

Global Car Sales Might Stay Below Pre-Pandemic Levels for Another Year

, Bloomberg News

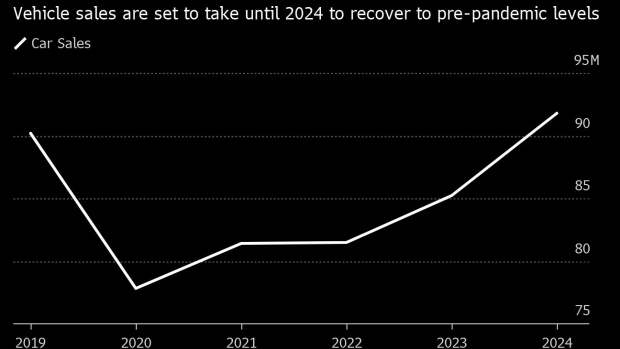

(Bloomberg) -- Passenger car sales in 2023 are set to trail levels from before the pandemic for a fourth year as supply-chain constraints give way to a drop in demand, according to LMC Automotive.

Deliveries are expected to reach about 85 million vehicles as consumers turn cautious, inflation bites and interest rates surge, the forecaster said Wednesday. That compares to about 90 million deliveries in 2019, the year before the coronavirus pandemic shuttered dealerships and kept people home.

“Demand is no doubt softening as the global economic outlook deteriorates and customers’ appetites for making a big-ticket purchase, such as a new car, are tempered,” Jonathon Poskitt, LMC Automotive’s director of global sales forecasts, said in a report. “Pre-pandemic global market volumes are not forecast before 2024, with risks remaining skewed to the downside, particularly given the potential for a much harder economic downturn.”

Car sales have stayed below 2019 levels after surging demand for consumer products cleared out global inventories of semiconductors, forcing manufacturers to idle plants. With few cars available, and manufacturers like BMW, Ford and Stellantis concentrating production on their biggest money-spinners, car prices have surged.

While carmakers are still working down long waiting lists, prices are set to ease as household budgets come under pressure and protracted supply-chain issues improve. In the US, the price of the average car has reached $46,000.

“As Europe and North America head into the winter months, economic prospects look increasingly dismal in the face of stubbornly high inflation, and underlying demand for new vehicles is inevitably being eroded,” the forecaster said.

For this year, LMC’s sales forecast is now five million units lower than before Russia’s invasion of Ukraine that triggered another wave of supply-chain disruption, it said.

©2022 Bloomberg L.P.