Jan 28, 2021

Global Gold Demand Seen to Rebound From 11-Year Low

, Bloomberg News

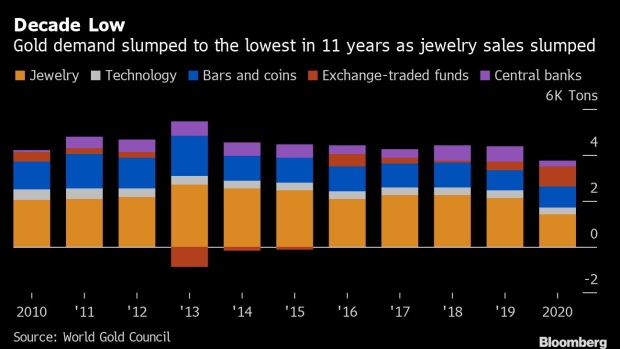

(Bloomberg) -- Global gold demand is set to recover this year, after slumping to the lowest in more than a decade in 2020, according to the World Gold Council.

With bullion prices climbing to an all-time high and pandemic lockdowns stifling consumption, demand for gold jewelry fell to the lowest on record last year, the WGC said in a report Thursday. That decline was led by the key Indian and Chinese markets, which experienced historically weak sales.

Now China’s economic recovery is supporting a rebound in demand, said Louise Street, the WGC’s senior markets analyst.

The outlook partly depends on investment demand, which surged to a record last year as inflows into exchange-traded funds more than doubled. That helped gold to climb by the most in a decade in 2020. Prices have declined this year as improving economic prospects drove Treasury yields higher, denting the appeal of the haven asset.

©2021 Bloomberg L.P.