Jun 2, 2023

Global Inflows Help Indian Stocks Become EM Asia’s Top Gainers

, Bloomberg News

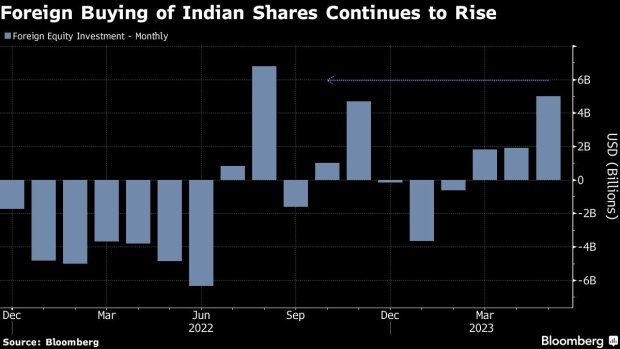

(Bloomberg) -- Foreign inflows into Indian stocks accelerated to a nine-month high in May as investors sought to capitalize on one of the fastest growth rates among major economies.

Overseas investors purchased a net $5 billion of the nation’s shares last month, the most since August, according to data compiled by Bloomberg. Global funds snapped up the stocks for 24 consecutive days through May 31, the longest streak since August 2016.

The buying spree has helped propel Indian equities to the top of emerging Asia’s leaderboard this quarter, with the Nifty 50 Index rallying more than 6%. A resilient domestic economy is a selling point, especially at a time when China’s recovery is losing momentum and the risk of a US downturn is growing.

“India will be one of the top two or three markets that will yield double digit corporate earnings for next five years compared to Europe and even China,” Rajiv Jain, GQG’s chief investment officer, said in an interview.

Cigarette and hotel group ITC Ltd., the country’s biggest drugmaker Sun Pharmaceutical Industries Ltd., along with lenders ranging from the State Bank of India and ICICI Bank Ltd. are among GQG’s key India bets, apart from recent investments in Adani Group firms.

--With assistance from Chiranjivi Chakraborty, P R Sanjai and Reinie Booysen.

©2023 Bloomberg L.P.