Jun 5, 2023

Global Junk-Rated Firms Are Paying the Highest Debt Costs Since 2010

, Bloomberg News

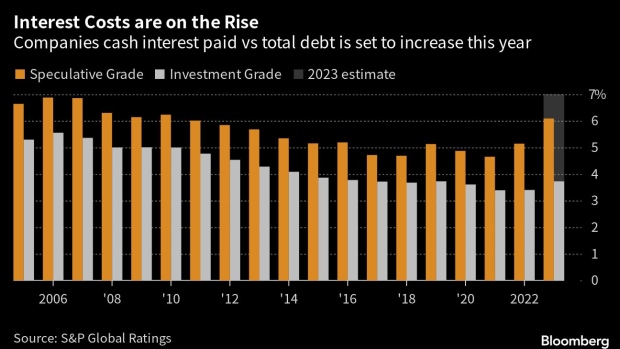

(Bloomberg) -- Companies are feeling the pinch from a sharp jump in interest payments after global rate hikes, with S&P Global Ratings estimating that junk-rated firms are paying the highest interest on debt since 2010.

Speculative-grade firms are now paying an effective rate of 6.1% on average, up from 5.1% last year, according to a report by S&P. It’s a dynamic that’s likely to spur greater efforts by companies to slash debt and conserve cash.

“If funding costs remain higher for the long term, this may force a rethink of capital structures and bring more focus on protecting cashflows,” said Gareth Williams, head of corporate credit research at S&P. “We could see greater efforts to reduce net debt, more use of equity in M&A, and more caution over capital expenditure.”

As firms face the prospect of higher rates for longer in the coming months following a steep tightening cycle, those with business plans built during the last decade of cheap money are getting hit with a new reality. High-yield firms in particular are having to deal with the dual impact of costly payments from floating-rate debt and lower earnings.

Investment-grade companies are generally seeing a more gradual change in effective interest rates, to 3.7% this year from 3.4%, but even so their credit situation is showing early signs of deteriorating.

Interest Coverage

Higher financing costs coupled with waning earnings growth is causing a measure of corporate borrowers’ ability to pay interest on their debt to weaken, according to strategists.

The average junk-rated company is generating lower earnings relative to interest expense, according to Bank of America Corp. strategists, based on a measure of income known as earnings before interest, tax, depreciation and amortization.

That ratio, known as the interest coverage ratio, has fallen after it peaked at around six times following the Federal Reserve slashing interest rates during the Covid-19 pandemic, BofA strategists led by Oleg Melentyev said. Higher figures are better for investors, because they signal a company has more capacity to pay its obligations.

For US non-financial, non-utility investment-grade firms, coverage declined to 11.91 times in the first quarter after reaching a record higher of about 13.73 times, according to a separate report by Bank of America.

The ratios are deteriorating in part because of declining profitability, which is broadly weighing on credit metrics, according to strategists at JPMorgan Chase & Co.

“Slow economic growth and stickier inflation on the cost side than the revenue side are leading to weaker credit metrics,” strategists led by Eric Beinstein wrote in a recent report, referring to high-grade corporations.

Leverage, meanwhile, is moving up modestly while interest coverage is moving down more quickly, as interest expense rises with higher market yields, they wrote.

Struggling Sectors

Some sectors are facing more pain than others. Housebuilders and developers, healthcare, aerospace and technology firms are among those seeing the highest rise in interest paid versus total debt. Property firms have been suffering, with struggling Swedish landlord SBB emblematic of the sector’s problems after rapid debt-fueled expansion.

Read more: A New Wave of Real Estate Pain Is Coming After European Rout

“The transition may be the hardest part. More vulnerable credits with capital structures built for a world of near-zero rates are more likely to default,” Williams said.

Other sectors, such as utilities and mining companies, have seen a lowering of their interest-to-debt ratio.

Globally, Latin America was the first region to see annual cash interest payments rise, yet now the pain’s being felt sharply in North America, Europe and Asia-Pacific.

“On the flip side, higher yields are attractive for investors so capital is likely to remain available,” Williams said.

(Updates with interest coverage detail from sixth paragraph)

©2023 Bloomberg L.P.