Jun 4, 2020

Global Recovery Hope Erases Pandemic Losses in Indonesian Assets

, Bloomberg News

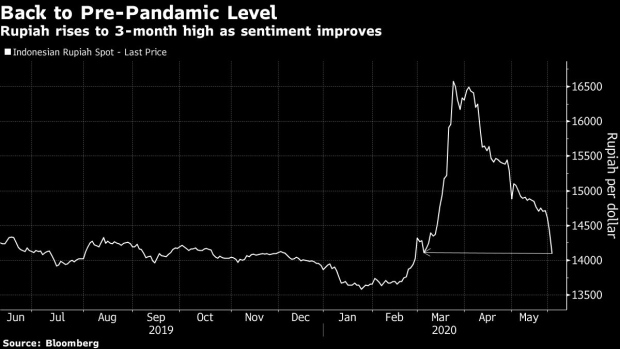

(Bloomberg) -- Indonesia’s rupiah and bonds are returning to levels seen before the pandemic as demand for higher-yielding assets surges on expectations of a quicker economic revival, with countries emerging from lockdowns.

The rupiah has gained over 15% this quarter, erasing most of the losses in the first three months of the year. The nation’s 10-year bond yield is back near 7%, around the level it started 2020.

“Expectations of lower-for-longer rates worldwide has raised Indonesian bonds’ appeal,” said Yanxi Tan, a foreign exchange strategist at Malayan Banking Bhd.

The rebound in Indonesian assets, often seen as a barometer of risk appetite for emerging markets in Asia, is another sign that investors are keen to look past the devastation wrought by the virus in their search for returns. The government saw a record amount of orders at a bond auction on Tuesday, while foreign funds have also started returning.

Overseas investors bought a net $973.2 million of Indonesia’s bonds so far this quarter after selling $8.61 billion in the first three months of this year, finance ministry data showed.

Indonesia’s central bank Governor Perry Warjiyo expects the rupiah to strengthen to 14,200 per dollar given the combined support from the central bank and government. “With global sentiments in most risk assets being bullish at the moment, it’s much easier for market participants to align themselves with the central bank’s view,” according to Maybank’s Tan.

The rally, mirrored in the nation’s benchmark stock index, comes even as the government warns of a widening fiscal deficit and slower-than-expected growth. The discrepancy between markets and economy is echoed elsewhere too.

“Markets are ignoring fiscal concerns and a weakening growth trajectory for the time being, with IDR appreciation being encouraged by the authorities,” said Mitul Kotecha, a senior emerging markets strategist at TD Securities in Singapore.

©2020 Bloomberg L.P.