Jun 14, 2022

Global Stock Rout Prompts Call for Back-to-Basics Investing

, Bloomberg News

(Bloomberg) -- Traders unnerved by a selloff that hit stocks and bonds alike are looking for refuge, increasing the appeal of investments offering reliable returns such as shares that pay steady dividends.

A rout that’s seen global stocks enter a bear market and so-called risk-free Treasuries slump is forcing investors to get creative. They are looking at assets like high-dividend shares, investment-grade bonds and Chinese stocks.

Investors are hoping the assets they buy will withstand any fallout from an expected accelerated pace of interest-rate hikes by the Federal Reserve to tame inflation that’s climbing at the fastest pace in four decades.

“We are arguing for adjusting the portfolio to get those exposures that make sense in the current environment,” said Peter Garnry, head of equity strategy at Saxo Bank A/S. “These themes are commodities, defense, logistics, cyber security and mega caps.”

Meanwhile, BlackRock Inc.’s Karim Chedid, head of the investment strategy team and senior strategist for iShares EMEA, said they prefer stocks that can navigate persistent inflation and more difficult margins, like healthcare and tech and generally defensive sectors with consumer price inelasticity.

Here’s a list of other assets that are attracting investors’ attention:

Free-Cash Flow Stocks

The era of easy money with very low or negative real rates is clearly over, according to Ellen Hazen, chief market strategist and portfolio manager at F.L.Putnam Investment Management. “It’s clear all that stuff we learn during our CFA exams and in business schools about how you value companies and this kind of cash flow, that matters again. And what that means is you want to own companies that are generating free cash flow,” she said on Bloomberg Television on Tuesday.

Health-care, insurance, and a few technology and software stocks in the S&P index generate a lot of free cash flow, which make them look appealing for F.L.Putnam.

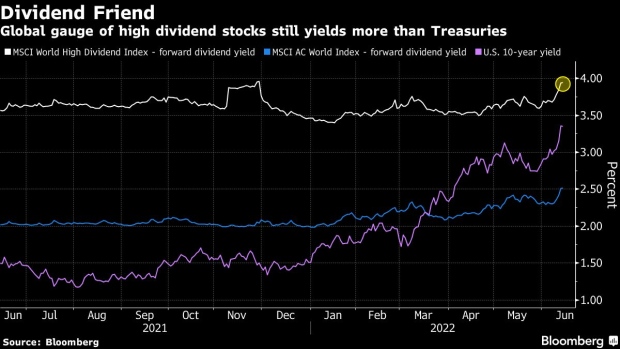

Dividend-Yield

Some investors are tweaking their dividend strategies. Marija Veitmane, senior strategist at State Street Global Markets, said high-dividend yielding stocks are the best place to hide along with commodities and large caps.

Central banks will keep raising rates as consumers and corporates continue to have a lot of cash and access to still-cheap borrowing, she said. “This is a very negative outlook for stocks, so we would be sellers of any rally.”

Sat Duhra of Janus Henderson Investors has been adding to positions in mainland Chinese shares, including in the renewable-energy infrastructure and water sectors, on attractive valuations and as they will be paying out dividends in June and July.

The Singapore-based portfolio manager is investing in Asian companies with dividend yields of around 6-8%. It “is a decent spread over bond yields and provides some protection in a period of heightened volatility,” he said.

Pricing Power

HSBC Holdings Plc has a list of stocks that tend to do well even in a weak macroeconomic environment, said Herald van der Linde, head of APAC equity strategy. “These stocks can do that because their businesses have pricing power, or they operate in a special niche or are key players in highly concentrated markets.”

Meanwhile, now that Asian economies are reopening, JPMorgan Asset Management sees the outlook for domestic demand improving in the region. Current earnings forecasts for Asian equities seem “too conservative for 2022 and valuation is also attractive once market sentiment improves,” wrote Tai Hui, Asia chief market strategist, in a note.

Mirabaud & Cie SA is also finding opportunities in stocks with pricing power, such as Sika AG, Geberit AG and Givaudan SA, said John Plassard, a director at the firm.

“With equity returns essentially bimodal and largely recession dependent, we focus on relative value opportunities and reassess our preferred themes and related screens,” UBS Group AG strategists including Keith Parker wrote in a note.

They are focusing on pricing power, stocks with higher and improving quality as well as shares exposed to high-income consumers.

China’s Stocks

For CEB International Investment Corp., now’s a good time to buy so-called new economy stocks in China including tech despite the regulatory risk there. “Lots of people one year ago thought this thing would be pushed like a more backward cycle for all the tech stocks,” said Banny Lam, head of research. “I am really positive about this sector, and in the second half of this year.”

Goldman Sachs Group Inc., meanwhile, remains bullish on China stocks as the government is easing overall policies, and it says the nation’s internet shares are still trading below their intrinsic value, strategists including Kinger Lau wrote in note.

Pictet Asset Management recently sold its China positions again because the zero Covid-19 policy is “too risky” and is underweight equities across the board right now in terms of geographies, said Frederic Rollin, senior investment adviser at the firm.

Investment-Grade Bonds

High-rated bonds strike a good balance between income generation and resilience against slowdown concerns, according to JPMorgan’s Tai Hui. While a short-term challenge for fixed income is risk from duration -- a measure of debt price’s sensitivity to interest-rate moves, income generated from government and corporate notes offers a better cushion to offset price volatility from rising rates.

“Now is the time to start re-building fixed income exposure” as central bank tightening anchors long-term inflation expectations, said Nannette Hechler-Fayd’herbe, chief investment officer of international wealth management and global head economics and research at Credit Suisse Group AG.

“Core government bonds and high grade corporate credits are offering decent yields now and emerging market hard currency bonds (for example in USD) are outright attractive,” she said.

(Updates with comments throughout.)

©2022 Bloomberg L.P.