May 23, 2019

U.S. stocks drop as China trade-war tensions rise

, Bloomberg News

BNN Bloomberg's closing bell update: May 23, 2019

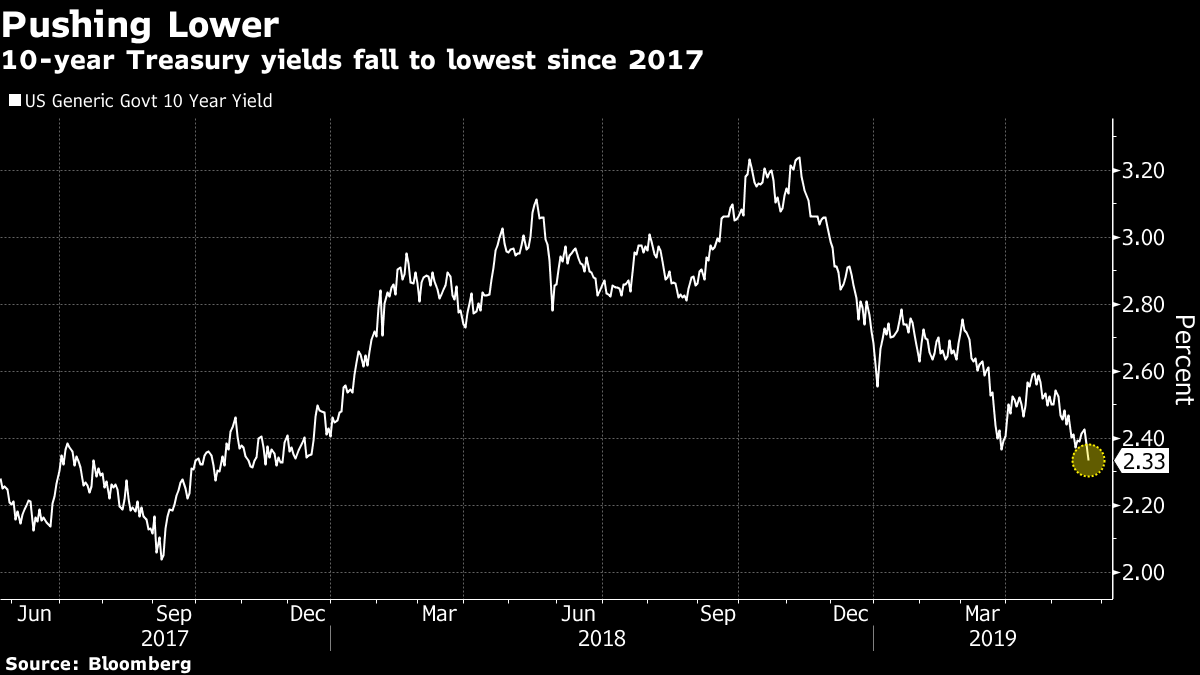

U.S. stocks retreated further on Thursday and investors sought refuge in gold and bonds as the world’s two largest economies hardened their trade-war stances. The yen gained against the dollar, while 10-year Treasury yields fell to their lowest since 2017.

The S&P 500 Index dropped for a fourth session in five, and the Dow Jones Industrial Average lost 286 points, after the Chinese Communist Party’s flagship newspaper published two commentaries assailing U.S. moves to curb Chinese companies.

Stocks in industries seen as susceptible to trade disruptions -- including semiconductors, automobiles and energy -- retreated. Emerging-market shares slid and West Texas crude fell below US$60 a barrel, while yields on bunds and gilts hit two-year lows.

Risky assets remain under pressure and havens in demand as investors dig in for what looks like a protracted trade dispute. One expert predicts tensions could endure until 2035, while economists are also turning more pessimistic. Goldman Sachs Group Inc. now sees higher odds of a stalemate between the two nations, and Nomura Holdings Inc. has shifted to forecasting a full-blown escalation of tariffs.

“Continued weak global economic data and the lack of a specific date for the resumption of U.S.-China trade talks are clouding earnings visibility and weighing on risk appetite,” said Alec Young, managing director of global markets research for FTSE Russell. “Markets are pricing in the harsh reality that trade tension is more likely to linger than quickly be resolved, as had been the consensus expectation anchoring sentiment until late April.”

The Stoxx Europe 600 Index had its worst day in two weeks as automakers tumbled after an EU official said the U.S. was unlikely to start trade talks with the bloc soon while it’s preoccupied with China. The dollar was little changed, while the British pound struggled to end its two-week losing streak against the euro.

Elsewhere, China’s yuan dipped in onshore trading even after the People’s Bank of China set its daily fixing at a stronger-than-expected level for a fourth straight day. West Texas crude had its biggest two-day drop of the year as inventory data alleviated concerns over a supply crunch. Commodities slumped across the board as traders increasingly girded for a full-blown trade war.

Here are some notable events coming up:

The European Parliament holds continent-wide elections May 23-26. On Thursday, the European Central Bank publishes its account of the April monetary policy decision.

And these are the main moves in markets:

Stocks

The S&P 500 Index declined 1.2 per cent as of 4:02 p.m. New York time. The Stoxx Europe 600 Index decreased 1.4 per cent to the lowest in more than a week. The U.K.’s FTSE 100 Index fell 1.4 per cent. The MSCI Emerging Market Index fell 1.4 per cent to a 19-week low.

Currencies

The Bloomberg Dollar Spot Index fell less than 0.05 per cent. The euro climbed 0.3 per cent to US$1.118. The British pound fell 0.1 per cent to US$1.2657. The Japanese yen advanced 0.7 per cent to 109.59 per dollar, the biggest gain in two months.

Bonds

The yield on 10-year Treasuries fell seven basis points to 2.31 per cent, the lowest in about 19 months. Germany’s 10-year yield fell three basis points to -0.12 per cent. Britain’s 10-year yield declined six basis points to 0.953 per cent, a 23-month low.

Commodities

West Texas Intermediate crude decreased 5.4 per cent to US$58.13 a barrel, the lowest in over 10 weeks. Gold gained 0.8 per cent to US$1,283.91 an ounce. The Bloomberg Commodity Index sank 1.3 per cent, its biggest decline in over 16 weeks.