May 11, 2021

Tech rout is a reminder of danger behind rich valuations

, Bloomberg News

Don't get caught up in the value trade 'fashion show': Bullseye's Adam Johnson

The turbulence rippling through technology stocks is a reminder of the extreme valuation risks lurking in the market high-fliers.

The Nasdaq 100 Index trades at 5 times sales and 35 times trailing earnings, rich levels by any historical measure. While investors have been able to overlook expensive prices in the bull run, the industry is now grappling with inflation fears and regulatory risk.

“The problem for tech is that it has been seen as a one-way ticket for the last decade,” said Neil Campling, an analyst at Mirabaud Securities. “It’s as if many investors have woken up and realized that inflation is real and isn’t transitory.”

The Nasdaq 100 dipped 0.8 per cent as of 9:57 a.m. in New York, extending Monday’s 2.6 per cent selloff.

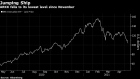

While the moves have been sharp, they’re minimal for now compared with the size of previous gains. The index stands just 5 per cent below all-time highs after more than doubling since the start of 2019.

Global technology stocks have dominated the investing landscape for a generation, benefiting from rock-bottom interest rates and the rise of online retail, cloud-computing and digital services in everyday life. But the risks are rising.

Inflation threatens to erode the value of future earnings power -- the biggest selling point for tech stocks. At the same time, regulatory scrutiny, extreme valuations and the prospect of tighter monetary policy ahead have given stock investors reasons to look elsewhere. In Europe, the Stoxx 600 Index sank 2 per cent on Tuesday, and Asia’s regional benchmark fell the most since March.

The conversation around tech stocks has shifted this year from one of unbridled optimism to concern about speculative froth and lofty valuations.

“This is the sore point, the Achilles heel, which could ultimately break the current bull market,” said Oliver Scharping, a portfolio manager at Bantleon AG. “We are somewhat concerned, but at the same time we think it’s still more a positioning, rather than a real inflation scare problem.”

For now, all eyes will be on the April inflation report, which is forecast to show that consumer prices increased 3.6 per cent during the month. While the figures will be distorted by plunging energy prices during last year’s lockdown, it’ll still feed into the debate about whether the Federal Reserve will pare back stimulus that’s kept equities buoyant.

“The big question is whether it’ll be a temporary or a long-term increase,” said Yoram Lustig, head of EMEA multi-asset solutions at T. Rowe Price. “And no one really knows because we’ve never had such conditions before.”

Lustig is recommending an underweight allocation to the U.S. and European equity market, and prefers value and small-cap shares over growth.

“It’s a good time to be more cautious,” he said. “We’re putting money from equities into things like cash so if there’s a correction and a buying opportunity, we can go back into the markets quickly.”

Other investors are sanguine about the market turbulence.

“We continue to see a very positive backdrop for the stock market and happy to buy the dip,” said Marija Veitmane, senior multi-asset strategist at State Street Global Markets. On inflation, “we are yet to see any indication of higher prices lingering.”

She said the firm’s core positions were in cyclicals, especially materials and industrials, with tech holdings as a defensive hedge.