Sep 27, 2019

Gold Buying Spree Adds $1.8 Billion to Fortunes of Metal Miners

, Bloomberg News

(Bloomberg) -- Billionaire fortunes are getting whipsawed by global trade tensions, but for one group -- tycoons with major holdings in gold-mining assets -- it’s a prosperous time.

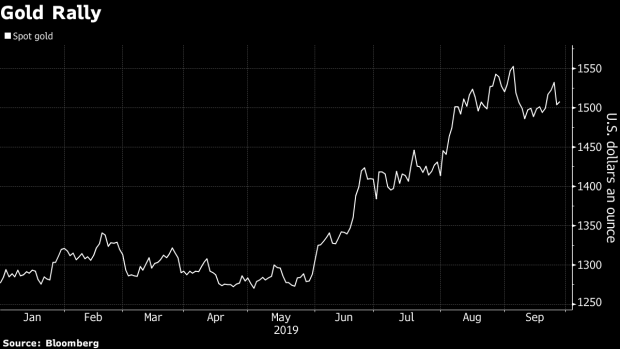

Four mining billionaires, including Egypt’s Naguib Sawiris and Russia’s Suleiman Kerimov, have grown their fortunes by $1.8 billion this year. Spurred by central bank easing, the metal has gained about 16% in 2019 and is poised for its best year since 2010.

The biggest gainer is Kerimov, whose family controls 78.6% of Polyus, the biggest gold producer in Russia. He’s followed by Sawiris who owns stakes in gold mines through his closely held company, La Mancha Resources. He told Bloomberg last year that he was one of the largest gold-mining investors in the world and expects prices will reach $1,800 an ounce. The metal traded at $1,492 at 6:53 a.m. in New York.

“You have to be buying at any level, frankly,” investor Mark Mobius said in a Bloomberg interview last month. “Gold’s long-term prospect is up, up and up, and the reason why I say that is money supply is up, up and up. With the efforts by the central banks to lower interest rates, they’re going to be printing like crazy.”

Other bulls include Ray Dalio, who runs the world’s largest hedge fund firm. He recommended buying gold in July as a way to profit while central bank stimulus nears its limit.

There’s also skepticism of the current rally. Guy Wolf, the global head of market analytics at Marex Spectron, said it’s difficult to make an argument for gold because it doesn’t pay yields and is battling a rising dollar.

--With assistance from Peter Eichenbaum.

To contact the reporter on this story: Alex Sazonov in Moscow at asazonov@bloomberg.net

To contact the editors responsible for this story: Pierre Paulden at ppaulden@bloomberg.net, Steven Crabill

©2019 Bloomberg L.P.