Feb 28, 2022

Gold Climbs as Sanctions Fuel Concerns of Global Hit to Growth

, Bloomberg News

(Bloomberg) --

Gold climbed as Western nations escalated sanctions on Russia for the invasion of Ukraine, heightening fears of a hit to global economic growth.

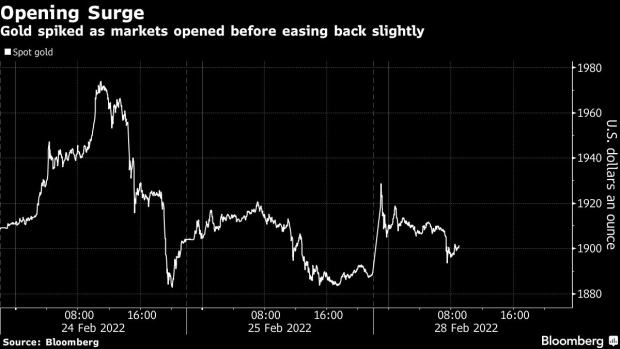

It surged as much as 2.2% at open after penalties were placed on the Bank of Russia to prevent it from using foreign reserves to blunt sanctions. They also excluded some Russian lenders from the SWIFT messaging system that underpins trillions of dollars worth of transactions.

The central bank raised its key interest rate to the highest in almost two decades and imposed some controls on the flow of capital in a bid to shield the economy as its currency plummeted. Concerns are now growing about whether the financial chaos may damage global economic growth or require action by the Federal Reserve to supply dollars.

Bullion is on course for its best month since May amid the fraught geopolitical tensions, having outperformed other havens. It will also be getting a boost from lower expectations of aggressive monetary tightening by the Fed to tame the highest inflation in decades.

Meanwhile the Russian central bank said on Sunday it would resume its gold purchases on the domestic market after a two-year pause. It holds over 2,000 tons in bullion already, making it the fifth biggest sovereign owner.

“The purpose of buying gold (in the domestic market), is to monetize it when required,” Nicky Shiels, head of metals strategy at MKS PAMP SA, wrote in a note. “It’s the fear over potential central bank sales that may overhang the market.”

Gold rose 0.5% to $1,899.03 an ounce at 9:23 a.m. London time, after earlier rising as high as $1,930.85 an ounce. Silver and platinum steadied, while palladium climbed 4.7%. It spiked as much as 7.8% earlier in the session on concerns about disruption of Russian exports, which produces about 40% of freshly mined supply.

©2022 Bloomberg L.P.