May 17, 2020

Gold Climbs to 7-Year High After Fed’s Stocks, Growth Warnings

, Bloomberg News

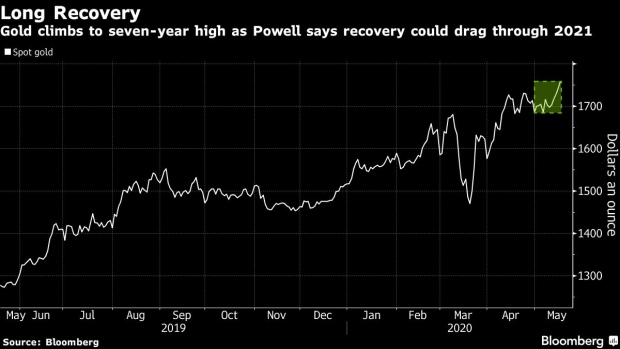

(Bloomberg) -- Gold rose to the highest in more than seven years after the Federal Reserve said stocks and asset prices could suffer a significant hit from the coronavirus pandemic, and warned the process of economic recovery may stretch through until the end of next year.

Commercial real estate could be among the hardest-hit industries should the health crisis deepen, the U.S. central bank said in its twice-yearly financial stability report Friday. Separately, Chairman Jerome Powell said in an interview with CBS that a full recovery of the U.S. economy could drag through 2021 and depends on the delivery of a vaccine.

Bullion has surged 16% this year as the spread of the virus curbed economic growth, roiled markets, and prompted vast amounts of stimulus to be unleashed by governments and central banks. Further bolstering the case for the metal has been recent speculation U.S. interest could go negative, while holdings in gold-backed exchange-traded funds are at a record.

Spot gold climbed as much as 0.9% to $1,760.14 an ounce, the highest since October 2012, and traded at $1,758.72 at 8:07 a.m. in Singapore.

“Financial markets can best be described as factoring in the best-case scenario, with economic stimulus leading to a rapid recovery,” said Gavin Wendt, senior resource analyst at MineLife Pty. “The reality is likely to be quite different and there is the prospect that no vaccine will be developed. The recovery is probably set to be more problematic than the optimists think, with gold set to benefit from the enormous boost to money supply that is going to ensue.”

Monday’s gain in gold comes after data released Friday underscored how hard virus-related shutdowns have hit the world’s largest economy. U.S. retail sales and factory output registered the steepest declines on record in April.

The Fed’s Powell is due to appear along with Treasury Secretary Steven Mnuchin before the Senate Banking Committee on Tuesday.

In other markets, silver climbed 2%, platinum jumped more than 3% and palladium rose 1.2%.

©2020 Bloomberg L.P.