Apr 15, 2020

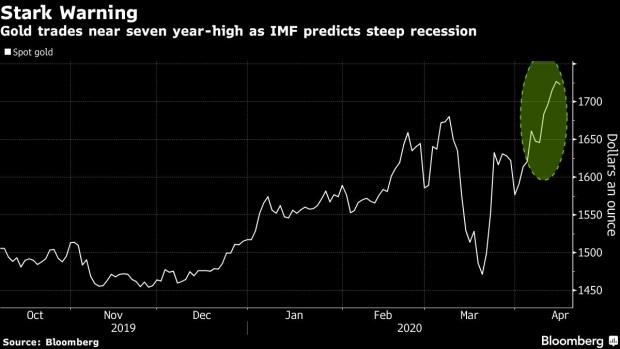

Gold Digs In Near Seven-Year High as IMF Warns, ETFs Swell Again

, Bloomberg News

(Bloomberg) -- Gold traded near the highest close in more than seven years as investors weighed the asset’s merits as a haven against a backdrop of dire predictions for a global recession, further hefty inflows into bullion-backed funds, and a softening dollar.

Spot bullion held its ground after a four-day surge, with the International Monetary Fund warning the pandemic-induced global recession will be the deepest since the Great Depression. Later Wednesday, U.S. retail sales data for March will add more detail on the damage as earnings season rolls on.

If the IMF “predictions were to materialize, we could see continued fiscal and monetary support, weakening budgets, possible debasement of currencies and an increase in demand for gold,” said John Sharma, an economist at National Australia Bank Ltd. “This will likely provide solid support.” Still, any progress on the health front might limit the metal’s upside, he said.

The precious metal has rallied 14% this year, supported by record holdings in bullion-backed exchange-traded funds, which rose again on Tuesday. Bullion’s resilience came even as leaders in Europe and some U.S. states prepared to ease lockdowns, with the coronavirus pandemic showing signs of easing. The dollar held near a one-month low.

Spot gold traded 0.3% lower at $1,721.93 an ounce at 11:04 a.m. in Singapore after ending at $1,726.97 on Tuesday, the highest close since November 2012. On the Comex, futures eased 0.9% after peaking at a seven-year high Tuesday.

In other precious metals, silver dropped 0.6% and palladium declined 0.8%, while platinum climbed 0.6%.

©2020 Bloomberg L.P.