Mar 25, 2021

Gold Heads for Weekly Decline as Investors Weigh Yield Outlook

, Bloomberg News

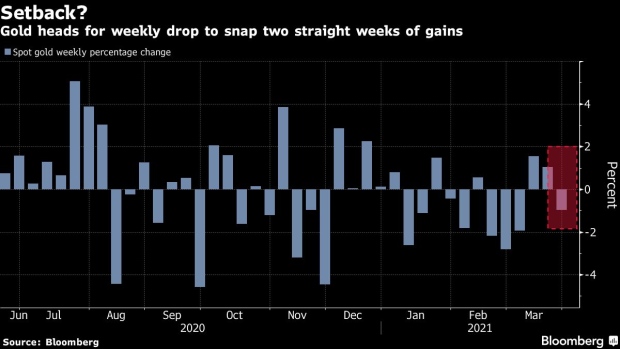

(Bloomberg) -- Gold headed for a weekly drop as investors weighed the outlook for yields and the economy with renewed concerns over the coronavirus.

Treasury yields briefly climbed to session highs on Thursday after a weak auction of 7-year notes echoed a disastrous sale last month that helped push yields higher. Appearing before the Senate Banking Committee on Wednesday, Federal Reserve Chairman Jerome Powell said the surge in yields reflected a brighter economic outlook as the vaccination roll-out accelerates and was not cause for concern.

President Joe Biden set a goal of administering 200 million vaccine doses by the end of April, doubling his target for his first 100 days in office. Still, virus cases in the U.S. are rising again, reversing course after months of decline and threatening another setback in the return to normality.

Bullion has dropped about 9% this year amid optimism over a recovery from the pandemic and the rise in bond yields, which weighed on demand for the traditional haven. Still, easier policy may last for a while, helping to cushion gold’s fall. Powell said this week that the Fed would wait until the economy has “all but fully recovered” to pull back the extraordinary monetary support it rolled out in response to the health crisis.

Spot gold was little changed at $1,726.52 an ounce by 9:21 a.m. in Singapore, and is down 1.1% this week to snap two straight weeks of gains. Silver, palladium and platinum were steady. The Bloomberg Dollar Spot Index ticked lower, paring a weekly advance.

©2021 Bloomberg L.P.