Apr 9, 2020

Gold Market Isn’t Going Back to Normal as Spreads Stay Wide

, Bloomberg News

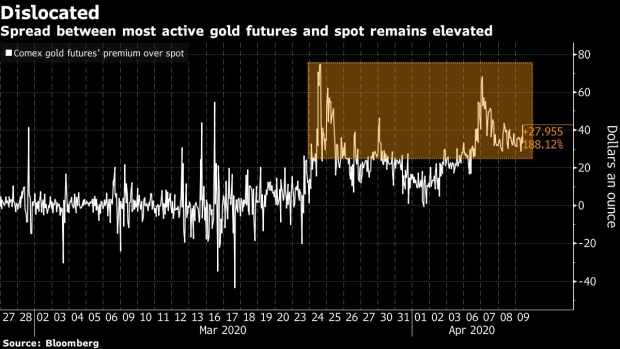

(Bloomberg) -- The gold market is showing no signs of going back to normal.

Spreads between New York and London have stayed around $40, a sign that traders are hesitant and liquidity is thin. It’s still difficult to ship gold around the world and traders have speculated that some dealers are pulling back given the logistical risks.

“The market itself is not broken,” said Rhona O’Connell, head of market analysis for EMEA and Asia at INTL FCStone. But it’s “thin and dislocated.”

To be sure, there’s plenty of gold available in New York, according to Comex. Total stockpiles tracked by the exchange almost doubled over the past week and are at record highs.

Spot gold rose 1% to $1,662.68 an ounce as of 11:35 a.m. in London. On the Comex, futures were more expensive at $1,706.

The gaps should be temporary as major refineries restart operations, Suki Cooper, precious metals analyst at Standard Chartered Bank, said in a note.

Read also: Gold Markets Are Being Haunted by Signs of Dislocation Again

©2020 Bloomberg L.P.