Jun 16, 2020

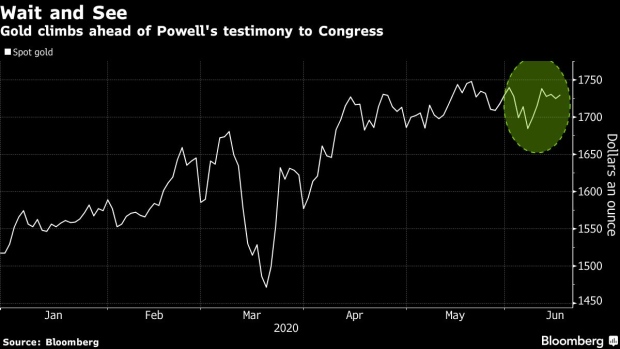

Gold Pushes Higher as Investors Prepare for Powell’s Testimony

, Bloomberg News

(Bloomberg) -- Gold pushed higher as investors counted down to testimony from Federal Reserve Chairman Jerome Powell on the central bank’s next steps to combat the hit from the coronavirus pandemic.

Powell, who delivers his semi-annual policy report on Tuesday and Wednesday, is expected to echo the downbeat view he gave June 10 after policy makers signaled rates would probably stay near zero through 2022. Bullion also got a lift from concerns over new outbreaks in the U.S. and a weaker dollar.

Bullion has rallied this year as the pandemic triggered an unprecedented wave of stimulus, bolstering the haven’s appeal. On Monday, gold pared a drop after the Fed said it will begin buying individual corporate bonds, and expanded a lending program. On Tuesday, the Bank of Japan revised the estimated size of its virus-response measures, while the Reserve Bank of Australia said the nation’s economy is likely to need policy support for some time.

“Gold has bounced back today amid a choppy U.S. dollar and as the Fed’s latest measures further highlight commitment by the central bank to take all possible measures,” said Madhavi Mehta, an analyst at Kotak Securities Ltd. “Fed Chairman Powell’s testimony is also likely to reflect the same.”

Spot gold rose as much as 0.5% to $1,733.07 an ounce, and was at $1,730.29 at 11:35 a.m. in Singapore after ending 0.3% lower on Monday. The Bloomberg Dollar Spot Index fell 0.4%, set for a back-to-back decline.

In addition to monetary easing, governmets around the world have stepped up their fiscal response. In the latest move, the Trump administration is preparing a nearly $1 trillion infrastructure proposal as part of its push to spur the world’s largest economy, according to people familiar with the plan.

China Outbreak

On the coronavirus front, global cases surpassed 8 million as Beijing shut seven central residential areas to contain a coronavirus cluster that’s of concern to the World Health Organization. U.S. Vice President Mike Pence discussed rising coronavirus cases in a call with state governors.

“The biggest challenge for gold is whether U.S. and global economies will reimpose lockdowns again if there is a major surge,” said Mehta. “Unless there are fresh restrictions, gold may struggle to build on the upward momentum.”

Separately, investors were tracking events in the Koreas. North Korean state media said Kim Jong Un’s regime is reviewing a plan to send its army into the demilitarized zone separating the country from the south. The announcement follows rising tensions with Seoul.

In other precious metals, silver climbed 0.3%, platinum added 0.5%, and palladium gained 0.8%.

©2020 Bloomberg L.P.