Feb 26, 2021

Gold Rout Deepens With Metal Set for Worst Month in Four Years

, Bloomberg News

(Bloomberg) -- Gold extended declines, heading for its worst month since late 2016 as the dollar advanced and Treasury yields pared losses.

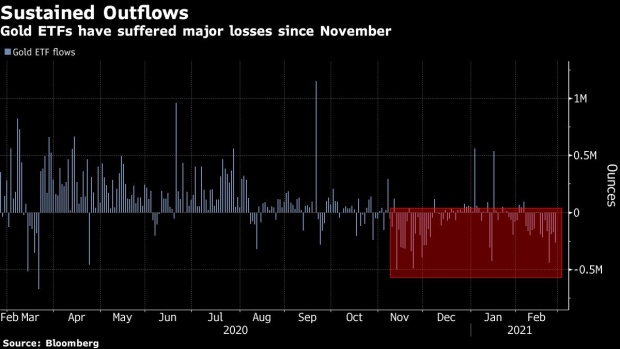

Gold has fallen more than 8% this year as traders focus on an economic recovery from the Covid-19 pandemic and higher Treasury yields, which make gold less competitive because it doesn’t offer interest. That has caused holdings in bullion-backed exchange-traded funds to fall to lowest in seven months. The U.S. dollar is heading for a second week of gains, further diminishing demand for gold as an alternative asset.

Gold “is having a rough 2021 and the only thing that can right the ship is if central banks thwart the trajectory of bond yields,” said Edward Moya, a senior market analyst at Oanda Corp. “The Fed will have plenty of opportunities to stem surging Treasury yields, but for now it seems they can be a little more patient.”

Federal Reserve Chairman Jerome Powell this week assured investors that the central bank is in no rush to pull back stimulus, boosting demand for many raw materials while further reducing the appeal of bullion as a haven asset.

Bullion declined further on Friday as traders exited positions, with U.S. equities trading mixed and global bond rout easing.

“Gold got hit aggressively just after the cash equities open today,” said Tai Wong, head of metals derivatives trading at BMO Capital Markets, noting that investors bullish on bullion sold their holdings after the metal failed to maintain the key levels of $1,760 to $1,765 an ounce in overnight trading.

Natixis’ Bernard Dahdah said he wouldn’t expect the same “collapse” in gold seen in 2011, “but clearly there will be some pressure on prices as economies in the West open up.”

He sees gold around $1,700 in the longer term given the abundance of liquidity in financial markets. Bullion may also face downward pressure from stock market selloffs as some investors look for cash to cover margin calls, he said.

Spot gold dropped 2.6% to $1,725.32 an ounce at 11:39 a.m. in New York, after slumping 1.9% on Thursday. It’s down more than 6.6% this month, on pace for its biggest drop since November 2016. Silver, platinum and palladium declined more than 3% on Friday, while the Bloomberg Dollar Spot Index rose 0.5%.

©2021 Bloomberg L.P.