Oct 19, 2021

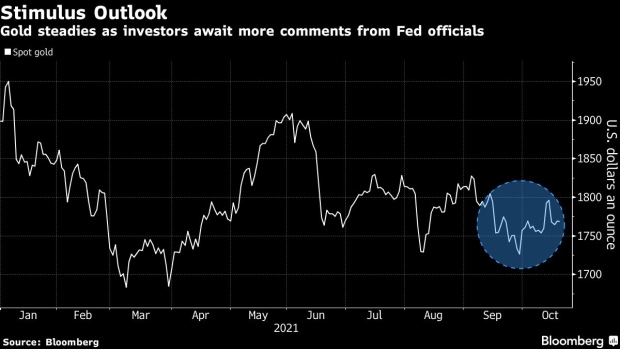

Gold Steadies as Investors Weigh Prospects of Stimulus Pullback

, Bloomberg News

(Bloomberg) -- Gold steadied as investors waited for comments from Federal Reserve officials this week which could provide insight into the prospects of tighter monetary policy.

Bullion has fluctuated recently as markets assess the possibility of earlier-than-expected tightening to contain inflationary pressures. Upcoming speeches and discussions by officials including Randal Quarles, Mary Daly and Chair Jerome Powell could provide more clues, after Governor Christopher Waller said Tuesday the Fed should begin tapering its bond-buying program next month, though interest-rate increases are probably “still some time off.”

Waller added the caveat that “if my upside risk for inflation comes to pass, with inflation considerably above 2% well into 2022, then I will favor liftoff sooner than I now anticipate.”

U.S. traders are now pricing a full rate hike into the Fed’s September policy meeting next year. But many of the world’s central banks, with the exception of the European Central Bank, are expected to move at a faster pace.

“Gold is trading above what we deem as fair value at this moment, and I believe this premium is due to the market pricing inflation fears,” said Howie Lee, an economist at Oversea-Chinese Banking Corp. “With the Fed due to begin monetary normalization, I still believe gold will face more downward pressure in the coming year.”

Spot gold steadied at $1,768.98 an ounce at 7:45 a.m. in Singapore, after rising 0.3% Tuesday. The Bloomberg Dollar Spot Index was little changed after dropping 0.3% in the previous session. Silver was slightly higher, while platinum and palladium edged lower.

©2021 Bloomberg L.P.